Ending 2023 With A Bang: SqSave Portfolios Outperformed and Ready For 2024

Jan 4, 2024

FY2023 has been an excellent year for our SqSave reference portfolios, with the majority of our portfolios beating or being on par with the benchmark. The following is a brief recap for 2023.

Riding the Wave of Change: SqSave Portfolios Demonstrate Resilience and Growth Amid 2023's Market Fluctuations

Dec 5, 2023

As in 2022, the year 2023 has been volatile for both equities and bonds. November, however, was a stellar month.

SqSave's 2023 YTD Returns Continue to Outshine Benchmarks & the Competition

Nov 7, 2023

Global equities continued their rollercoaster ride In October, buffeted by elevated US Treasury bond yields, geopolitical tensions, and a mixed corporate reporting season.

SQSAVE RESILIENCE IN THE FACE OF MARKET TURBULENCE

Oct 4, 2023

This year has been a rollercoaster for global markets. But even in the face of challenges, SqSave continues to stand out with our proven strategy and steady performance. Let’s delve into our performance for September 2023.

SqSave YTD Aug 2023 Portfolios +9.6% to +16.1%: Outperforming Benchmarks & Competitors

Sep 5, 2023

At SqSave, we’re proud to share our respectable performance - especially for 2023 - that sets us apart from the competition. If you're looking to make your money work harder for you, it's time to consider putting your trust in SqSave.

SPOTLIGHT ON THE FED’S RISING DEBT & ITS DILEMMA

Sep 4, 2023

The Fed looks at the core PCE (Personal Consumption Expenditures Price Index, Excluding Food and Energy). In August 2023, the core PCE was 4.3%, still far from the 2% target.

What’s inside SqSave ONE Dollar Portfolios

Aug 15, 2023

Thanks to our proprietary SqSave investment engine, we have automated investing the way it should be - seeking out better returns based on your preferred risk appetite over the medium to long term.

Decoding Investment Performance: Total Return vs. Time-Weighted Return

Aug 11, 2023

Investing in financial markets comes with its fair share of challenges and complexities.

SQSAVE PORTFOLIOS DELIVERS RESPECTABLE PERFORMANCE AGAINST COMPETITORS IN 2023

Aug 4, 2023

On a Year-to-Date basis (till end July 2023), all our SqSave reference portfolios outperformed key competitors.

SQSAVE PORTFOLIOS GROWS +9% to +15% (JAN to JUNE 2023)!

July 3, 2023

All SqSave reference portfolios delivered outstanding results in the first 6 months of 2023.

SqSave Portfolios Continues Their Stellar Performance

June 6, 2023

The US debt ceiling deal clears congress, ending the threat of a potentially catastrophic US debt default.

Robust SqSave Performance Since 2023

May 5, 2023

The Federal Reserve (“Fed”) on Wednesday announced its tenth consecutive interest rate rise, raising federal funds rate to a range of 5 to 5.25%, and has signalled that it is close to pausing interest rate hikes.

Outstanding SqSave Performance in March & YTD 2023

Apr 5, 2023

Core inflation remains stubborn in both the U.S. and the Euro area, with no signs of stabilizing back at central banks' 2% targets.

Encouraging SqSave Performance Since Start of 2023

Mar 14, 2023

The recent volatility in the stock market can be attributed to various factors, including persistent inflation, changing interest rate expectations, economic growth worries, earnings results paired with future guidance and evolving geopolitical events.

SqSave Portfolios Performed Strongly in January

Feb 15, 2023

Last year, many central banks around the world focused on fighting inflation by implementing rate hikes while guiding investors and the general public about the expected economic impact of their rate hiking campaigns (in their attempts to anchor and gradually reduce future inflation expectations).

ADOPT A CALM AND DISCIPLINED INVESTING APPROACH

Jan 18, 2023

It’s funny to see human psychology confused about investing and gambling.

Majority of SqSave’s Portfolios Outperformed Peers over Past 2-Years!

Dec 13, 2022

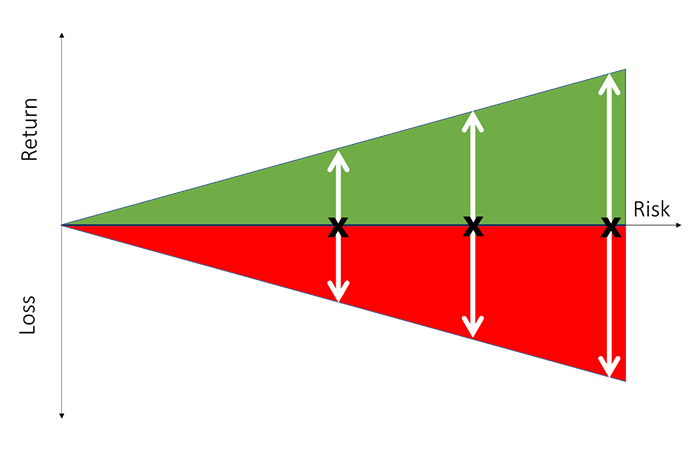

As we approach the end of calendar 2022, we highlight how our SqSave algorithms have managed the lower risk portfolios under heightened market volatility.

2023 MARKET OUTLOOK

Nov 29, 2022

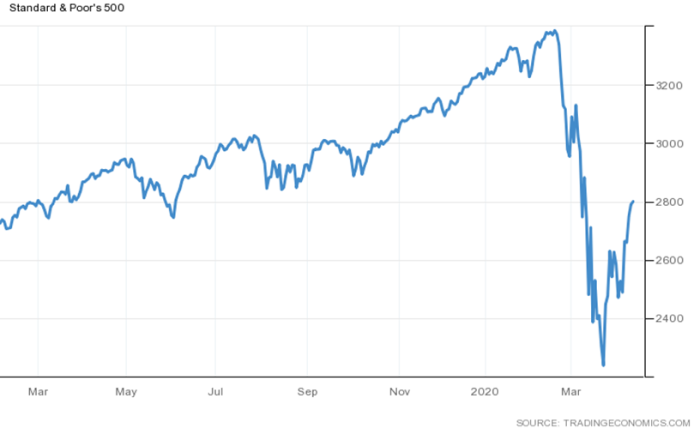

We are dealing with extended anxiety in recent months. So far this year, the S&P 500 was down over 25% percent at its lowest closing level on 12 Oct 2022.

SqSave Outperforms Benchmarks over Past 1Y & 2Y Periods

Nov 8, 2022

On a longer-term trailing 1 and 2-year basis, SqSave’s returns have mostly outpaced their benchmarks. In particular, our low to mid-risk portfolios have outperformed their benchmarks by 22.4%, 18.3%, and 10.4%, respectively. Following yet another month of wild market gyrations, SqSave’s reference portfolios managed to recoup some of their year-to-date downbeat performance.

STAY INVESTED & INVEST REGULARLY

Oct 6, 2022

A growing sense of despair seems to be taking hold across world markets as fears of recession abound, induced by the US Federal Reserve Bank’s aggressive interest rate hikes to fight inflation. Year to date until end September 2022, the S&P 500 and NASDAQ Composite Indices have reached bear market lows of -24.8% and -32.4%, respectively.

SQSAVE CONTINUES TO FOCUS ON ASSET ALLOCATION TO MANAGE LONGER TERM RISKS

Sep 6, 2022

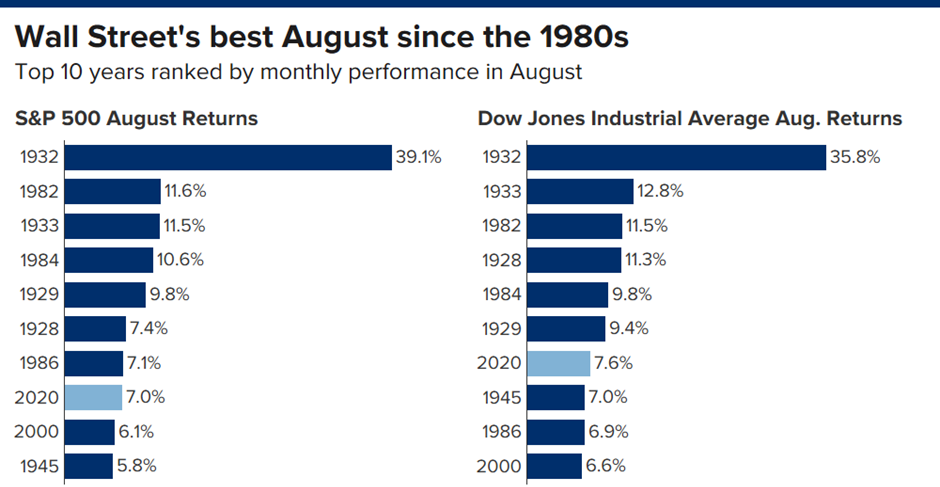

Our algorithms are not focused on short term monthly movements, but we monitor closely. That said, August was a poor month for our algorithms. Even then, we focus on more than one month as our algorithms are not designed to be trading oriented. Our data analytics for investing focus on at least a one-year time horizon.

Investment Lessons from SqSave Portfolios’ Strong Growth in July 2022

Aug 2, 2022

While our lower risk portfolios did very well in the first few months of 2022, our mid to higher risk reference portfolios registered strong positive returns in July 2022.

SQSAVE INVESTMENT PERFORMANCE STANDS OUT AMONG THE REST

July 9, 2022

In a 6th July 2022 6th July 2022 seedly.sg comparison of digital advisers, SqSave’s investment performance (in red box) is overall relatively better than the others.

During this Heightened Market Volatility, a Disciplined AI-Quant driven Approach is Better

June 13, 2022

The month of May is a sea of red for investing. This follows a “brutal April”. Almost everyone and everything is down, except inflation of course!

EMERGING FROM A BRUTAL APRIL 2022…

May 6, 2022

Our SqSave AI algorithms have steered our lower risk reference portfolios to show positive returns of 1.9% to +2.5% for the trailing 3 months & +0.6% to +4.2% for trailing 12 months up to 30 April 2022. This is remarkable given how most other competitors have shown negative returns for the same periods.

SqSave AI outperforms: +2.6% to +4% returns in March 2022!

Apr 6, 2022

Our 12 Feb 2022 blog, “SqSave AI seems to know something’s happening” highlighted how our SqSave AI in Jan 2022 boldly sold out of Fixed Income investments and invested heavily in Gold/Commodities for the lower risk Conservative & Balanced reference portfolios.

HOW SQSAVE AI RISK-MANAGED PORTFOLIOS PERFORMED OVER TIME

Apr 1, 2022

Unlike other well-advertised competitors, SqSave has focused on its 100% AI system to deliver value to our clients.

COMPARE AI-DRIVEN vs HUMAN-DRIVEN INVESTMENT DECISIONS

Mar 28, 2022

The recent market correction since Dec 2021 into Jan/Feb 2022 revealed how our investment AI system managed downside risks across our lowest risk to highest risk portfolios.

SqSave Conservative Portfolio up +3.65% for the month of Feb & 0.10% YTD

Mar 11, 2022

In our 12 Feb 2022 blog, “SqSave AI seems to know something’s happening”, we shared our quant AI team’s observation of SqSave AI switching boldly out of Fixed Income instruments into Gold and Commodities – particularly for the lower risk Conservative & Balanced reference portfolios.

Insights Into SqSave AI’s Dynamic Asset Allocation

Mar 3, 2022

In this blog, we share insights into SqSave AI which helped our low-risk reference portfolio achieve +3.24 per cent growth in the month of February 2022!

What the Russia-Ukraine Crisis Means For Savvy Investors

Feb 24, 2022

After months of brazen military build on the Ukraine borders, the Russia-Ukraine standoff has moved from words to aggressive actions. We hope war and conflict can be averted. But that is not to be.

SqSave AI seems to know something’s happening

Feb 12, 2022

The Jan 2022 market correction resulted in the SqSave AI algorithms rebalancing the various reference portfolios.

SqSave ONE Dollar Reference Portfolios

Feb 5, 2022

As SqSave offers global portfolios from as low as ONE Dollar, we showcase the ONE Dollar portfolios below.

SqSave Reference Portfolios riding out short term volatility

Feb 5, 2022

Volatile start to 2022 for both equity and bond markets

5 Investing Insights & Strategies From Chinese New Year Games

Feb 3, 2022

Gambling is a huge part of the Chinese New Year festivities. Pick up some investment knowledge while enjoying these popular CNY games!

3 Smart Ways to Grow Your Child’s HongBao Money

Jan 19, 2022

Financial literacy and saving for a rainy day is a life skill that you, as parents, should start teaching your young children.

SqSave - Looking Ahead as we begin 2022

Jan 8, 2022

Is the market going to crash again like when Covid caused global panic in Feb 2020? Will the USA Federal Reserve move to start increasing interest rates crash the markets? You get the picture.

SqSave ONE Dollar Reference Portfolios

+12% & +17% during Jan-Dec 2021

+19% & +31% in 18 months since May 2020

Jan 8, 2022

SqSave offers global portfolios from as low as ONE Dollar. No more excuses!

SqSave Reference Portfolios Outperform Significantly in 2021

Delivered +14% to +25% Returns for whole year 2021

Jan 8, 2022

December 2021 saw jittery markets as the US Federal Reserve signaled an end to monetary easing. Inflation fears continue. Omicron threatened more infection waves.

SQSAVE INVESTMENT OUTLOOK 2022

Dec 21, 2021

Covid-19 saw dramatic expansionary fiscal and monetary policies across the world in 2020 and 2021.

7 Ways SqSave AI is Revolutionising Investing

Dec 13, 2021

Frequently dubbed one of the "next big things in tech", Artificial Intelligence (AI) applications have significantly evolved. From search engines to money management, AI brings unique solutions and possibilities to the table with its ability to harness vast amounts of data and make inferences about new data – beyond human capabilities.

SqSave Reference Portfolios Doing Well Despite Headwinds

Delivered +15% to +25% Returns YTD end-Nov 2021

Dec 3, 2021

November saw US equity markets setting new record highs but fell abruptly at month-end due to fears over the emerging Omicron Covid-19 variant, stubbornly high inflation due to global supply constraints and worries about the Federal Reserve’s next steps.

SqSave ONE Dollar Reference Portfolios

+14% & +19 during Jan-Nov 2021

+21% & +33% in 18 months since May 2020

Dec 3, 2021

We track two actual ONE Dollar SqSave portfolios which started in May 2020.

Invest in the Best Gift for Your Loved Ones this Christmas

Nov 11, 2021

Gifting season is here! Want more meaning & value from your gift spending? Then get SqSave's Gift-a-Portfolio! Ideal for family, loved ones and friends, SqSave Gift-a-Portfolio grows financial security for life.

SqSave Reference Portfolios Racing Ahead!

+13% to +21% (Jan-Oct 2021)

Nov 5, 2021

SqSave’s Reference Portfolios have risen +13% to +15% in the first 10 months of 2021, much higher than the estimated low single digits by competitors.

SqSave ONE Dollar Reference Portfolios

+12.3% & +15.2% in first 10 months of 2021

+19% & +29% in 17 months since May 2020 inception

Nov 1, 2021

We set up two actual ONE Dollar SqSave portfolios in May 2020.

8 Ways To Build Your Child's Financial Literacy

Oct 5, 2021

Here are some ways you can develop your child's financial literacy habits from an early age.

Sep 2021 SqSave Reference Portfolios Outperform

+11% to +15% YTD end-Sep 2021

Oct 5, 2021

Seasonally, September tends to be the worst performing month of the year. SqSave has managed to perform well despite headwinds.

SqSave ONE Dollar Portfolios:

Update +18% & +26% in 15 mths!

Sep 6, 2021

We designed SqSave to start investing from ONE Dollar that we can help the unbanked millions, and those badly served with expensive financial products.

End-Aug 2021

SqSave Performance Update

Reference Portfolios Edge Up Further in Aug 2021

+13% to +19% YTD end-Aug 2021

Sep 6, 2021

We are pleased to report that SqSave reference portfolios rose further in Aug 2021, beating some other competitors significantly this year.

SQSAVE PERFORMANCE UPDATE

Reference Portfolios +12% to +16% YTD end-July 2021

Aug 5, 2021

On the back of very good returns for the first 6 months of 2021, our SqSave reference portfolios rose further in July 2021.

INVESTMENTS AS A MEANINGFUL GIFT FOR A FRIEND OR A LOVED ONE!

Jul 27, 2021

Wouldn’t it be good to teach the virtue of sharing or saving instead of spending?

Why not give an investment portfolio to friends and family instead of buying the usual gifts?

SqSave ONE Dollar Portfolios: +16% & +22% in 13 mths!

Jul 1, 2021

Over many years of investing experience, I realised that we are after all, human. Instead of really investing, we are mostly speculating and timing the markets.

SQSAVE: +11% to +13% IN FIRST HALF 2021

Jul 1, 2021

In our end-May 2021 blog, we talked about being disciplined and quantitative, instead of following traditional investment folklore. Data proves it is better to stay invested instead of timing markets. That’s why we created SqSave AI to track markets 24/7.

MY SQSAVE PORTFOLIO: +35% in 25 months

Jun 26, 2021

Last night, someone who had read my blog dated 2 April 2021 asked about my SqSave portfolio…

GLOBAL VACCINATION CHALLENGE & GROWING INTEREST IN CRYPTO ASSETS

Jun 5, 2021

As we closed the first week of June, the leading USA exchanges were boosted by better-than-expected jobs data. The flagship Dow Jones Industrial Average (DJIA) and S&P 500 hovered around recent record highs while the Nasdaq Composite which had experienced a tech selloff recovered.

SELL IN MAY & GO AWAY?

May 31, 2021

There is a popular saying, "Sell in May and go away”! While we investment folks may call it folklore (no pun intended 😊), SqSave’s investment team takes a quantitative approach to make sense of it.

LATEST! APRIL SQSAVE PERFORMANCE: UP +7.3% TO +8.6%

Apr 30, 2021

Following our first quarter 2021 performance update, SqSave is pleased to see that our Tactical Asset Allocation (TAA) adjustments are delivering good results!

SQSAVE PORTFOLIOS ARE UP +5.7% TO +7.0% IN FIRST QUARTER 2021

Apr 13, 2021

At SqSave, we use data-driven Artificial Intelligence (AI) and Machine Learning (ML) techniques to optimize portfolio returns within projected risk parameters.

MY SQSAVE PORTFOLIO: +27% in 22 months (+14% per annum)

Apr 2, 2021

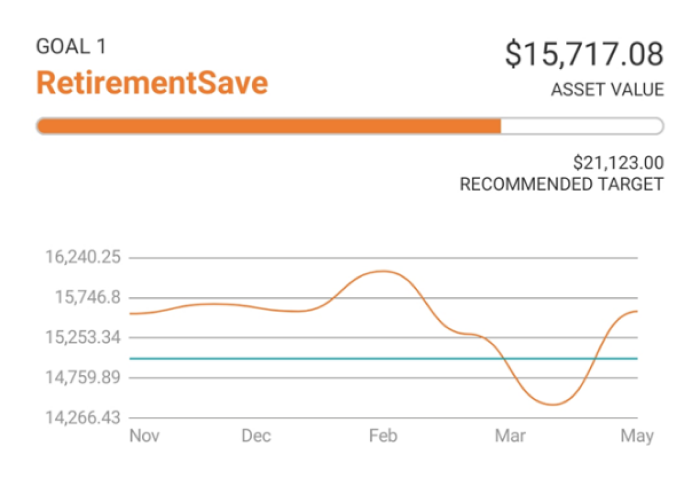

As at end-Mar 2021, my SqSave portfolio is up +27% since June 2019 (or 14% p.a)… Here, you can see that my portfolio which started in June 2019 with just SGD 15,000 is now worth almost SGD 19,000.

Pandemic One Year on with Vaccines, Global Recovery & Rise of Crypto...

Mar 16, 2021

All of us still breathing should give pause to mourn those who have perished during this pandemic. Going forward, we must be mindful of the immense and uneven suffering wrought by Covid-19.

Go Digital & Gift a SqSave Hongbao this “Niu” Year!

Feb 8, 2021

As we kick off the “Niu” Year of the Ox, SqSave invites you to go digital and gift a SqSave investment portfolio – instead of a cash Hongbao.

Stay Invested & Reap Better Returns

Jan 20, 2021

After years in investments, I realised that there was a limit to my capability. There is only so much information I can process within a given time. Yet, the world of investing was getting more complex.

How did My SqSave Portfolios Do in 2020?

Jan 4, 2021

As we start investing for 2021, let’s review my SqSave portfolios which I set up along the way since 2019.

As 2020 closes, what lies ahead for global investment markets?

December 10, 2020

Investment markets are expecting Biden to be sworn in as the next US President on 20 Jan 2020 - assuming Trump does not upset the apple cart. Investment markets do not like uncertainty.

Blistering November Gains for Stock Markets Even As Covid Rages On

December 1, 2020

Enthusiasm about vaccines drove USA stock markets to record highs in November 2020.

Risk Management Still Critical - As It Always Has @ SqSave

November 1, 2020

In the past two weeks, the stock market has become choppy. Headlines scream about the largest fall since whenever. That’s obvious, right?

The Best Time to Invest?

October 7, 2020

Sorry to burst your bubble. There is no such thing as the best time to invest, unless you are a historian.

Market Update – 1 Sep 2020

September 1, 2020

August 2020 has seen a recovery. While DJIA remains around 4% below its pre-Covid high, the S&P500 has finally broken through and setting new record highs.

Anyone Can Enjoy Smart Investing – Starting From One Dollar

August 31, 2020

A one dollar global portfolio? Yes! SqSave is designed to help anyone invest with low cost, using the power of AI and global diversification.

Time to Take Stock of Investing (no pun intended)

August 14, 2020

Since our launch, we had a decent ride managing market risks using our machine learning AI engine. The Covid crash showed that our system is crash-proof.

Glad that SqSave is Navigating Smartly Amidst this Crisis

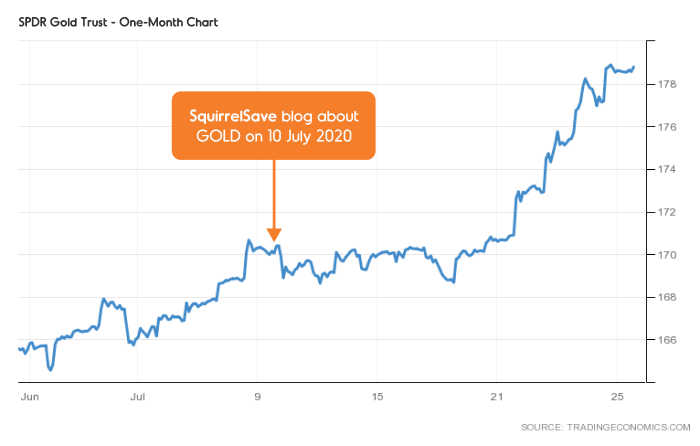

July 25, 2020

Two weeks since I wrote about SqSave’s bold allocation to Gold in my portfolio (and yours too, if you are a SqSave client), Gold continues to rise.

Shhh!!! My SqSave Portfolio Seems o Know Something About Gold

July 10, 2020

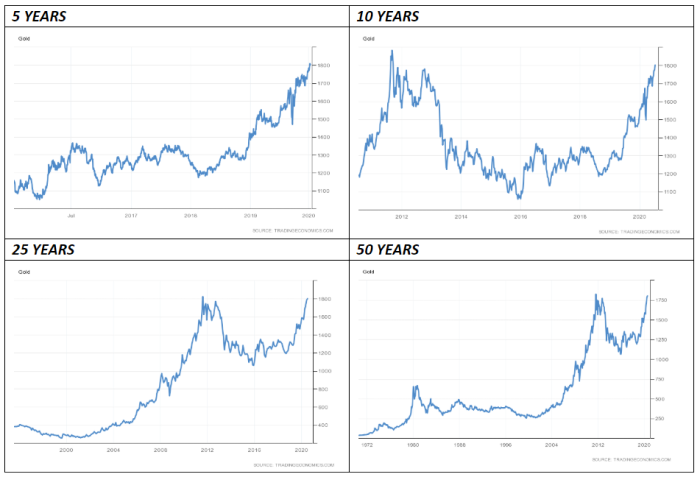

5-Year chart shows that gold is suddenly doing well in June 2019. 10-Year chart shows that gold is now back to its previous peak seen in Aug 2011.

How My SqSave Portfolio Behaved Through the Covid-19 March 2020 Market Crash

May 19, 2020

We have trained our investment system to cover the 2008 Global Financial Crisis, it is interesting how it navigates a live market crash and ongoing volatility.

Sharp Recovery Since the Covid-19 Crash

Apr 14, 2020

China's Shanghai Composite and Japan's Nikkei 225 closed at their highest since mid March 2020. Is this sharp recovery for real?

Getting It Right: Realised and Unrealised Gains/Losses

Apr 7, 2020

In typical gambling behaviour, people are mostly heading for the exits because they have lost everything (including what they won previously).

Is Covid-19 different from the past crisis?

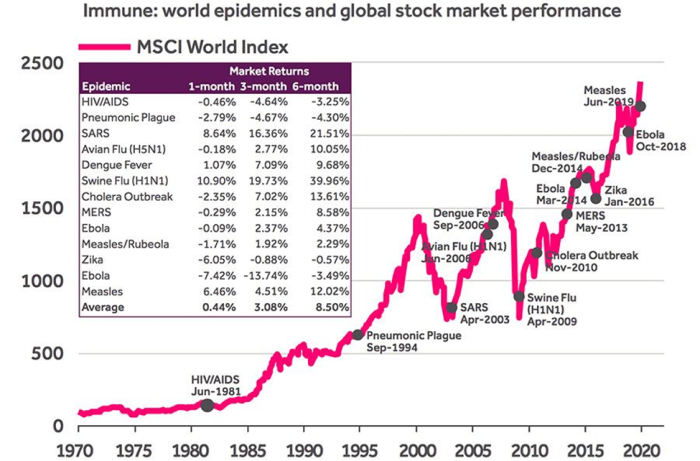

March 30, 2020

Yes, Covid-19 is different from the causes of previous crises. There is deliberate policy-induced economic contraction – unlike other crises.

Covid-19: Defining Your Investment Experience

March 30, 2020

The IMF is forecasting a global recession in 2020. On the bright side, some analysts are forecasting a recovery as early as the third quarter of 2020.

Covid-19: Has Fear Run Ahead of Markets?

March 9, 2020

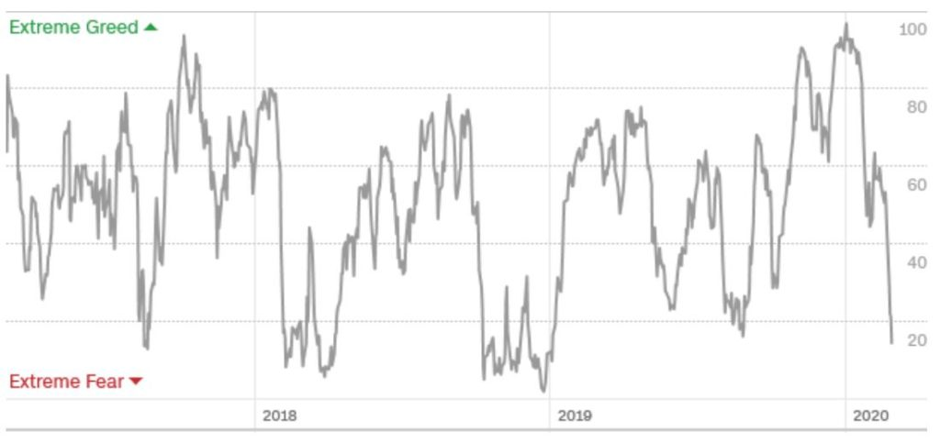

Greed and fear are the driving forces behind buying and selling decisions. We buy when there is an excessive greed. We sell when there is an excessive fear.

Market Update Mar 2020

March 2, 2020

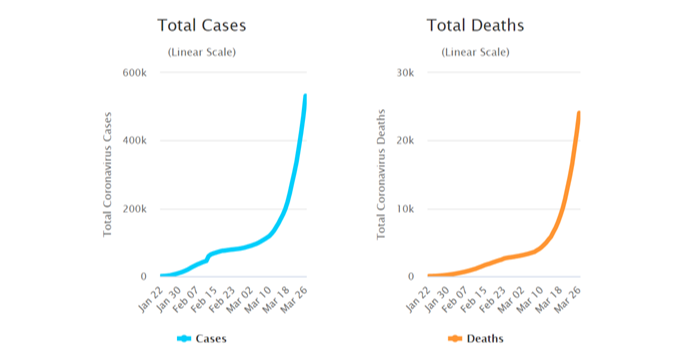

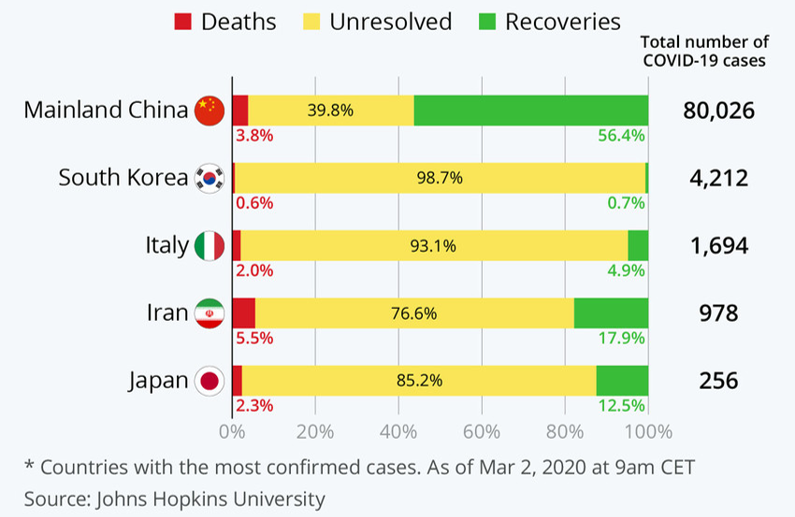

Major benchmark indices such as the Dow, S&P 500 and Nasdaq had the worst week since the Global Financial Crisis of October 2008. The CNN Fear And Greed Index has retraced from extreme greed levels in January to deep fear levels.

SqSave portfolios are doing fine despite Covid-19

February 25, 2020

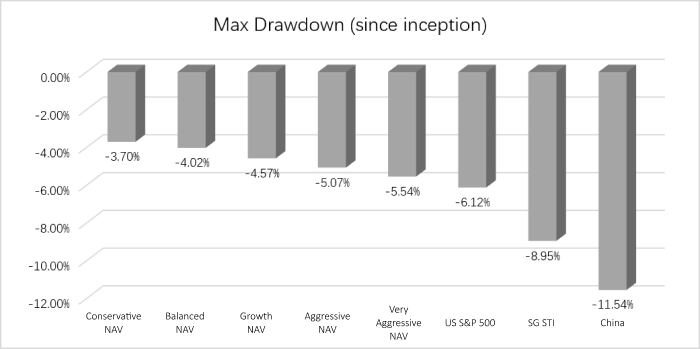

Despite the world fighting the Covid-19 outbreak, SqSave's portfolios are still showing positive performance. Our investments are well-diversified across global markets; mainly allocated to US REITS, US stocks, and China A-shares.

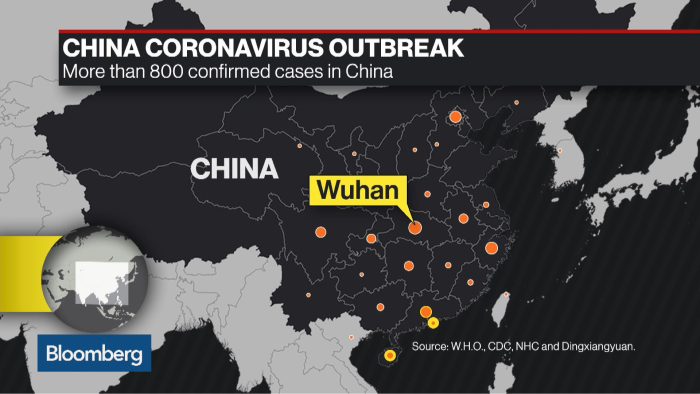

How Covid-19

Affects Investment Strategy

January 30, 2020

As with any flu outbreak, there will likely be an acceleration in the number of infections before it peaks and slows down. In the meantime, stay away from high-risk areas, practice good personal hygiene and use common sense. But what about our investments?

Stop Paying

for Bad Performance

November 1, 2019

In the investment world, those who have more money pay the lowest fees. Those who have less money to invest - pay much more. It’s painful to see how these small investors are fleeced every day.

Whitepaper: SqSave’s

F.A.M.E

[Factor Analytics Machine Learning Engine]

Victor Lye, CFA CFP®, Yi-Chen Chia, CFA CAIA FRM

Contents

Section 1: Introduction

Section 2: Pivot’s Factor Modelling with Machine Learning Analytics

Section 3: Portfolio Optimization on Pivot’s Factor Model

Section 4: Personalized Solution – Dynamic Advisory and Rebalancing

Market Update Aug 2019

Aug 10, 2019

The global risk outlook has risen compared to 3 months ago. Concerns over global growth remain high amidst trade war fallout fears. Gold touched fresh multiyear highs while bond yields continue to fall. Negative interest rates threaten wiggle room for policy actions.

Smart Investing with

Global Diversification at SqSave

Jun 13, 2019

Internet social media has shifted the way news or facts are delivered and perceived – with profound implications for the way we should invest. I am asked by many these days about the implications for their investments because of the news frenzy about the USA-China trade war. I can understand the anxiety. Yet, I need to remind ourselves about our human short-term memories.

Why Replace The Human

Investment Manager?

May 21, 2019

When investors ask me what I do, I cheekily tell them that I intend to replace their human investment manager. They think I am doing a marketing pitch for them to appoint me as their investment manager. When I clarify that I am not proposing myself in place of their investment manager and add that I am not claiming to be better than their investment manager, they get puzzled and curious.

The Good Old Days,

and The Fantastic Days Ahead...

May 7, 2019

Many years ago, when I was a stockbroker, I researched companies listed on various stock exchanges. Based on my research, I would recommend buying or selling the listed shares of specific companies to professional fund managers who typically managed unit trusts or mutual funds[1].

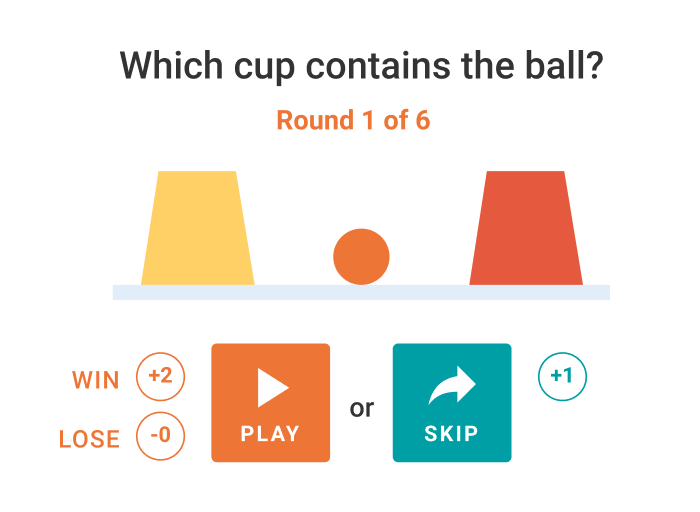

Applying Serious Gaming

to Improve Risk Profiling Analytics

Team SqSave

In this White Paper, we share how SqSave breaks new ground with gamification of risk profiling to restore some order to the muddied world of personal investing.

What You Should Know About Unit Trusts

April 18, 2019

If you are new to investing, it can be very intimidating. Not everyone is schooled in finance or accountancy. Even for first-timers schooled in finance or accountancy, it can be confusing. Not everyone has the same gung-ho risk attitude. Yet there is a fear of losing out when you hear boasts from people who say how much money they made from investing.

Is Risk Profiling Just Another Questionnaire?

April 11, 2019

For too long, investing has lost its way. With so many financial products and hard-selling, we risk paying too much for something unsuitable. It is an uneven playing field. Yet, we are to blame.

Psst! Are you investing, gambling or speculating?

April 5, 2019

Many people say they invest. But they are really gambling or speculating! What aboout you? The difference in investing, gambling and speculating is in the underlying personal behavior which depends on attitudes towards the risks involved.

JAN 2024

Ending 2023 With A Bang: SqSave Portfolios Outperformed and Ready For 2024

DEC 2023

Riding the Wave of Change: SqSave Portfolios Demonstrate Resilience and Growth Amid 2023's Market Fluctuations

乘风破浪:SqSave投资组合在2023年市场波动中展现韧性和增长

NOV 2023

SqSave's 2023 YTD Returns Continue to Outshine Benchmarks & the Competition

OCT 2023

SQSAVE RESILIENCE IN THE FACE OF MARKET TURBULENCE

SQSAVE面对市场动荡的韧性

SEP 2023

SqSave YTD Aug 2023 Portfolios +9.6% to +16.1%: Outperforming Benchmarks & Competitors

SQSAVE 截止 2023 年 8 月的今年迄今投资组合表现 +9.6% 至 +16.1%:超越基准和竞争对手

SPOTLIGHT ON THE FED’S RISING DEBT & ITS DILEMMA

AUG 2023

What’s inside SqSave ONE Dollar Portfolios

Decoding Investment Performance: Total Return vs. Time-Weighted Return

SQSAVE PORTFOLIOS DELIVERS RESPECTABLE PERFORMANCE AGAINST COMPETITORS IN 2023

SqSave在2023年对比竞争对手表现优异

JULY 2023

SQSAVE PORTFOLIOS GROWS +9% to +15% (JAN to JUNE 2023)!

SqSave投资组合在2023年1月至6月期间增长了9%至15%!

JUNE 2023

SqSave Portfolios Continues Their Stellar Performance

SqSave投资组合持续表现出色

MAY 2023

Robust SqSave Performance Since 2023

SqSave自2023年以来表现保持强劲

APR 2023

Outstanding SqSave Performance in March & YTD 2023

MAR 2023

Encouraging SqSave Performance Since Start of 2023

自2023年初以来,SqSave持续着鼓舞人心的表现

FEB 2023

SqSave Portfolios Performed Strongly in January

SqSave投资组合在1月份表现强劲

JAN 2023

ADOPT A CALM AND DISCIPLINED INVESTING APPROACH

DEC 2022

Majority of SqSave’s Portfolios Outperformed Peers over Past 2-Years!

在过去两年中,SqSave的大部分投资组合的表现都优于同行!

NOV 2022

SqSave Outperforms Benchmarks over Past 1Y & 2Y Periods

SqSave在过去1年和2年期间的表现优于基准。

OCT 2022

STAY INVESTED & INVEST REGULARLY

保持投资和定期投资

SEP 2022

SQSAVE CONTINUES TO FOCUS ON ASSET ALLOCATION TO MANAGE LONGER TERM RISKS

SqSave继续专注于资产配置以管理长期风险

AUG 2022

Investment Lessons from SqSave Portfolios’ Strong Growth in July 2022

松鼠储蓄组合在2022年7月强劲增长的投资经验

JULY 2022

SQSAVE INVESTMENT PERFORMANCE STANDS OUT AMONG THE REST

松鼠储蓄的投资业绩脱颖而出

JUNE 2022

DURING THIS HIEGHTENED MARKET VOLATILITY, A DISCIPLINED AI-QUANT DRIVEN APPROACH IS BETTER

在这个市场波动加剧的时期,有纪律的人工智能-量化驱动的方法是更好的选择...

MAY 2022

EMERGING FROM A BRUTAL APRIL 2022…

走出残酷的2022年4月...

APR 2022

SqSave AI outperforms: +2.6% to +4% returns in March 2022!

SqSave AI表现优异。2022年3月,+2.6%至+4%的回报!

HOW SQSAVE AI RISK-MANAGED PORTFOLIOS PERFORMED OVER TIME

松鼠储蓄AI不同风险管理投资组合的长期表现

MAR 2022

COMPARE AI-DRIVEN vs HUMAN-DRIVEN INVESTMENT DECISIONS

人工智能与人类的投资决策:谁更聪明?

SqSave Conservative Portfolio up +3.65% for the month of Feb & 0.10% YTD

SqSave保守型投资组合2月份上涨了+3.65% 今年以来上涨了0.10%

Insights Into SqSave AI’s Dynamic Asset Allocation

了解一下松鼠储蓄人工智能的动态资产配置情况

FEB 2022

What the Russia-Ukraine Crisis Means For Savvy Investors

在有恐惧的时候投资、贪婪时须恐惧

SqSave AI seems to know something’s happening

松鼠储蓄所的AI似乎知道有事情发生

SqSave ONE Dollar Reference Portfolios

松鼠储蓄一美元参考组合

SqSave Reference Portfolios riding out short term volatility

松鼠储蓄参考投资组合渡过短期波动期

5 Investing Insights & Strategies From Chinese New Year Games

JAN 2022

3 Smart Ways to Grow Your Child’s HongBao Money

SqSave - Looking Ahead as we begin 2022

SqSave - 2022年伊始我们展望未来

SqSave ONE Dollar Reference Portfolios

+12% & +17% during Jan-Dec 2021

+19% & +31% in 18 months since May 2020

松鼠储蓄一美元参考投资组合

2021年1-12月期间,+12% & +17%。

自2020年5月以来的18个月内+19% & +31%。

SqSave Reference Portfolios Outperform Significantly in 2021

Delivered +14% to +25% Returns for whole year 2021

松鼠储蓄参考投资组合在2021年表现突出

2021年全年实现了+14%至+25%的回报率

DEC 2021

SQSAVE INVESTMENT OUTLOOK 2022

7 Ways SqSave AI is Revolutionising Investing

SqSave Reference Portfolios Doing Well Despite Headwinds

Delivered +15% to +25% Returns YTD end-Nov 2021

松鼠储蓄的参考投资组合在逆境中表现良好

2021年11月底的YTD回报率为+15%至+25%。

SqSave ONE Dollar Reference Portfolios

+14% & +19 during Jan-Nov 2021

+21% & +33% in 18 months since May 2020

松鼠储蓄一美元参考组合

2021年1-11月期间增值+14% & +19

自2020年5月以来的18个月内,+21% & +33%

NOV 2021

Invest in the Best Gift for Your Loved Ones this Christmas

SqSave Reference Portfolios Racing Ahead!

+13% to +21% (Jan-Oct 2021)

SqSave参考投资组合飞速增长!

+13%至+21% (2021年1月至10月)

SqSave ONE Dollar Reference Portfolios

+12.3% & +15.2% in first 10 months of 2021

+19% & +29% in 17 months since May 2020 inception

松鼠储蓄一美元参考组合

2021年前10个月,+12.3%和+15.2%。

自2020年5月开始以来的17个月内,+19%和+29%。

OCT 2021

8 Ways To Build Your Child's Financial Literacy

Sep 2021 SqSave Reference Portfolios Outperform

+11% to +14% YTD end-Sep 2021

2021年9个月SqSave参考组合表现优异

截止到2021年9月底的投资回报率为+11%至+14%。

SEP 2021

SqSave ONE Dollar Portfolios:

Update +18% & +26% in 15 mths!

SqSave一美元投资组合。

15个月内上涨了+18%和+26%!

End-Aug 2021

SqSave Performance Update

Reference Portfolios Edge Up Further in Aug 2021

+13% to +19% YTD end-Aug 2021

2021年8月底 松鼠储蓄的最新表现

参考投资组合在2021年8月进一步上升

截止到2021年8月底,累计回报率+13%至+19%。

AUG 2021

SQSAVE PERFORMANCE UPDATE

Reference Portfolios +12% to +16% YTD end-July 2021

松鼠储蓄业绩更新

2021年至7月底参考投资组合累计回报率+12%至+16%

JUL 2021

INVESTMENTS AS A MEANINGFUL GIFT FOR A FRIEND OR A LOVED ONE!

投资作为一个有意义的礼物送给朋友或爱人!

SqSave ONE Dollar Portfolios: +16% & +22% in 13 mths!

SqSave一美元投资组合:13个月内增值+16%和+22%!

SQSAVE: +11% to +13% IN FIRST HALF 2021

SQSAVE:2021年上半年增长+11%至+13%。

JUN 2021

MY SQSAVE PORTFOLIO: +35% in 25 months

GLOBAL VACCINATION CHALLENGE & GROWING INTEREST IN CRYPTO ASSETS

MAY 2021

APR 2021

LATEST! APRIL SQSAVE PERFORMANCE: UP +7.3% TO +8.6%

最新信息! 4个月松鼠储蓄(SQSAVE)的表现:上涨+7.3%至+8.6%

SQSAVE PORTFOLIOS ARE UP +5.7% TO +7.0% IN FIRST QUARTER 2021

松鼠储蓄的投资组合在2021年第一季度上涨+5.7%至+7.0%

MY SQSAVE PORTFOLIO: +27% in 22 months (+14% per annum)

我的松鼠储蓄(SQSAVE)组合:22个月内增值+27%(每年+14%)

MAR 2021

Pandemic One Year on with Vaccines, Global Recovery & Rise of Crypto...

疫苗,大流行一年后,全球复苏和加密货币的崛起

FEB 2021

Go Digital & Gift a SqSave Hongbao this “Niu” Year!

这个 "牛 "年,迎接数码化,送松鼠储蓄(SqSave)红包!

JAN 2021

Stay

Invested & Reap Better Returns

保持投资并获得更好的回报

How did My SqSave Portfolios Do in 2020?

DEC 2020

As 2020 closes, what lies ahead for global investment markets?

Blistering November Gains for Stock Markets Even As Covid Rages On

NOV 2020

Risk Management Still Critical - As It Always Has @ SqSave

OCT 2020

SEP 2020

AUG 2020

Anyone Can Enjoy Smart Investing – Starting From One Dollar

Time to Take Stock of Investing (no pun intended)

JUL 2020

Glad that SqSave is Navigating Smartly Amidst this Crisis

Shhh!!! My SqSave Portfolio Seems to Know Something About Gold

MAY 2020

How My SqSave Portfolio Behaved Through the Covid-19 March 2020 Market Crash

APR 2020

Sharp Recovery Since the Covid-19 Crash

Getting It Right: Realised and Unrealised Gains/Losses

MAR 2020

Is Covid-19 different from the past crisis?

Covid-19: Defining Your Investment Experience

Covid-19: Has Fear Run Ahead of Markets?

FEB 2020

SqSave portfolios are doing fine despite Covid-19

JAN 2020

How Covid-19 Affects Investment Strategy

NOV 2019

Stop Paying for Bad Performance

OCT 2019

Whitepaper:

SqSave’s F.A.M.E

[Factor Analytics Machine Learning Engine]

AUG 2019

JUN 2019

Smart Investing with Global Diversification at SqSave

MAY 2019

Why Replace The Human Investment Manager?

The Good Old Days, and The Fantastic Days Ahead...

APR 2019

Whitepaper: Serious Gaming in Risk Profiling

What You Should Know About Unit Trusts