SquirrelSave is a digital investment manager and the consumer brand of Singapore-incorporated PIVOT Fintech Pte. Ltd. (“PIVOT”) (UEN 201716150D). PIVOT is regulated by the Monetary Authority of Singapore and holds a Capital Market Services Licence (CMS 100806).

SquirrelSave's founder is Victor Lye, who has over 25 year of leadership experience in investments, insurance and healthcare. Shareholders include the PINTEC Group, a NASDAQ listed technology company based in China, the Pacific Century Group and other angel investors. PINTEC's AI technology cuts across credit analytics, wealth management and insurtech, and has been adopted by several financial institutions in China.

SquirrelSave designs personalized investment portfolio(s) matched to your risk profile when you ask for it. We manage your portfolio(s) for you on an on-going basis. You don't have to make any investment decisions. Simply decide how much risk you want to take and how much to invest. We do the rest.

SquirrelSave uses machine learning AI to design and manage globally diversified investment portfolio(s) customized for every investor.

SquirrelSave's investment strategy is based on the investment philosophy of Nobel Prize winning Markowitz’s Modern Portfolio Theory ("MPT"). Using the MPT framework, SquirrelSave's proprietary algorithms and statistical models uses real-time data to predict a portfolio diversifed across different investments that generates the highest possible return for the given risk exposure.

SquirrelSave's technology involves training our algorithms to progressively improve their predictive power by using "training data" comprised of actual outcomes, mathematical optimization and data analytics. The algorithms adopt machine learning AI techniques to correct its "mistakes" by comparing its predictions against live data outcomes in real-time, adjusting its computational variables and predicting again, all in rapid succession, without being explicitly programmed to do so. That's machine learning.

Machine learning ("ML") is the science of getting computers to act without being explicitly programmed. ML has become so common that you are already using it. For example, in spam-email filtering, online language translation, self-driving cars, speech recognition, web search, and more. Machine learning algorithms build a mathematical model of sample data, known as "training data", in order to make predictions or decisions without being explicitly programmed to perform the task. Machine learning is closely related to computational statistics, which focuses on making predictions using computers.

SquirrelSave has two main proprietary technologies, namely (i) SquirrelSave Risk Profiler; and (ii) SquirrelSave Digital Asset Allocation System.

Our SquirrelSave Risk Profiler adopts Game Theory which focuses on risk-reward choices and behaviour. We believe that this is an improvement over the traditional questionnaire approach which is not scientifically validated. Moreover, respondents may not understand the technical nature of the questions. Our SquirrelSave Risk Profiler simply requires you to make a series of risk-return decision(s). By analysing the risk you accepted for the desired return, and the sequence of your decisions with respect to the random results, and the actions of others with similar demographics, our SquirrelSave Risk Profiler builds on its AI capability to predict your risk profile.

Our SquirrelSave Digital Asset Allocation System ("DAAS") uses the principles of Nobel Prize winning Markowitz’s Modern Portfolio Theory ("MPT") to drive SquirrelSave's proprietary algorithms with real-time data to predict a diversified investment portfolio whose risk-return outcome fits your personal risk profile identified by our SquirrelSave Risk Profiler or as determined by you.

The DAAS involves (i) Data Analytics (ii) Portfolio Accounting System and (iii) Trade Optimisation. Our proprietary Data Analytics system makes sense of real-time data which feeds into our SquirrelSave Portfolio Accounting System to generate the recommended portfolios based on MPT, and the trade orders, as necessary. The Trade Optimisation Module accounts for market friction costs such as execution commissions, fees, bank charges, etc, with the aim of structuring efficient investment decisions to achieve a lower friction cost than if you were to execute the transactions personally.

SquirrelSave focuses on achieving good risk-adjusted returns by predicting market trends across different asset classes to minimize portfolio volatility over the medium to long-term.

SquirrelSave differs from typical "robo-advisers" in two main aspects:

(i) Portfolio design

(ii) Investment management

(i) "Robo-advisers" are typically "digital shopfront, human kitchen" in nature, where investment decisions are ultimately made by human managers. As such, robo-adviser "human kitchens" offer "pre-made" model investment portfolios to match your risk profile. In contrast, SquirrelSave is a “digital shopfront, digital kitchen” system using machine learning AI without human bias. SquirrelSave designs your investment portfolios that matches your risk profile - only when you ask for it - using real-time market data and risk-return predictions.

(ii) When it comes to managing your investments, SquirrelSave is forward-looking. Everyday, SquirrelSave assesses real-time data and predicts several risk-return scenarios that match your personal risk profile. Portfolio rebalancing is done on a "per investor" basis, and only if SquirrelSave predicts that a particular predicted risk-return outcome will be better than your current portfolio. In contrast, typical robo-adviser "human kitchens" rebalance your investments "backwards" to its "pre-made" model portfolios, which may no longer be relevant due to constant changes in market conditions.

Of course! We humans should do what we do better than machines. And let the machines do what humans cannot do better. Our human Squirrels will focus on customer support and making sure things work as planned. Our investment team which designed the algorithms monitor and assess performance everyday to ensure that the overall system works as planned.

SquirrelSave has only just obtained the Capital Markets Services licence and commenced business in early 2019. However, SquirrelSave's base machine learning AI technology applied to the MPT investment framework has been tested since 2015, and rolled out commercially by SquirrelSave's shareholder, Pintec Group, in China to over 20 financial institutions since 2016. The algorithms have been applied to mainly mutual funds which offer global asset allocation with good results in line with the design. As such, Pintec Group has a 2-year reference track record for the respective financial institutions in China. The algorithms have also been adapted for use by a USA registered investment adviser where the algorithm performance is reported to the US Securities Exchange Commission.

If you want to invest (grow your savings with a measure of risk over a time frame of over one year), then SquirrelSave will work for you. SquirrelSave harnesses the power of AI to manage your investment risk in real-time with consistency, which is humanly not possible. Humans get emotional, need time out and cannot cope with voluminous data. Machines can do the work consistently without rest, can see patterns that we don't even recognise.

Global investment markets keep moving as one part of the world goes to sleep and another part starts its workday. Tracking investment risks must cover huge volumes of data in real-time, all the time. Computing power has advanced tremendously. Hence, machines can manage risk consistently over the medium to long term. Humans will be affected by emotions and cannot process voluminous data efficiently.

SquirrelSave's investment AI team is led by Victor Lye with over 25 years' leadership experience in investments, insurance and healthcare. He has led research, stockbroking, corporate finance, asset management, private banking, insurance and healthcare. Most of all, he has seen investment cycles since the 1980s. Victor founded SquirrelSave in the belief that machine learning AI is better than traditional investment methods that charge clients too much.

If you invested in a mutual fund or unit trust that is actively managed, then you have to decide if the active management of the human manager is worth the fees you are paying. Further, you should assess that the investment management risk is suitable for you.

You should assess your investment objective. If you wish to invest in a diversified global portfolio, then you should seriously consider SquirelSave.

No. SquirrelSave is not a trading platform nor is SquirrelSave offering trading style investments. Investments require risk management over volatile market cycles. Therefore, time horizon is very important in a proper investing approach. SquirrelSave only accepts investors who are prepared to take more than one year time horizon or longer. In our view, an investor should take preferably at least a three year time horizon to manage risk over the market cycles.

Compared to 20 years ago, investment markets are more globally connected. Companies are now global businesses. Investing globally allows you to access better investment opportunities.

Currently, SquirrelSave offers Global ETF Portfolio.

Global ETF portfolio is a global investment service offering you a diversified portfolio of Exchange Traded Funds ("ETFs"). It invests in ETFs that represent a broad range of asset classes such as Equites, Fixed Income, Commodities, etc. The Global ETF portfolio asset classes also cover economic development segments, regions, countries, sectors and others.

Exchange traded funds (ETFs) are investment funds that are listed and traded on a stock exchange. ETFs cover a broad range of asset classes and can give exposure to specific markets, sectors or investment strategies.

Like mutual funds and unit trusts, your money invested in a specific ETF is pooled with money from other investors in the same ETF, and invested according to the ETF's stated investment objective.

An ETF typically aims to produce a return that tracks or replicates a specific index such as a stock index or commodity index. Such index tracking ETFs are passively managed by ETF managers with fees and charges that are usually lower than those of actively managed investment funds.

Investing in an ETF is done by buying units in the ETF. There is capital gain when the price of the units rises above the price paid for them. ETFs are not principal-guaranteed. Some ETFs pay dividends. ETFs may have complex structures which involve the use of derivatives.

You can learn more about ETFs at www.moneysense.gov.sg

ETFs are useful instruments for asset allocation:

(i) Diversification: You can gain exposure to an index without having to invest in all its component stocks.

(ii) Cost: ETFs tend to have lower fees and charges than actively managed investment funds such as unit trusts. There is also usually no sales charge, although brokerage commissions/transfer taxes will apply as ETFs trade like any other security on a stock exchange.

(iii) Liquidity: As ETFs are traded on a stock exchange, you can buy and sell units of ETFs throughout the trading day.

(iv) Valuation: ETFs prices are readily available on the stock exchange where they are listed, unlike unit trusts where prices are indicative.

For a more complete understanding of ETFs, you can refer to www.moneysense.gov.sg

For portfolio design, SquirrelSave has a risk-return framework with different data-driven categories. For each category, our SquirrelSave DAAS optimises or predicts a portfolio asset allocation everyday using the latest market information. These categories are not necessarily the same everyday as our DAAS uses real-time data to keep our risk-retun models up-to-date 24x7. Rebalancing is not done with reference to market price changes causing a deviation from the orginal (historical) designed portfolio. At SquirrelSave, rebalancing is done with reference to the predicted future portfolio and the current portfolio reflecting real-time market prices. SquirrelSave only rebalances an individual's client portfolio when there is a statistical significance in the deviation between a given investor’s market priced portfolio and the predicted optimal portfolio in the relevant category the client belongs to.

Yes, our SquirrelSave DAAS will design your own personal investment portfolio based on your risk profile, time horizon and age versus the prevailing and predicted (optimised) risk-return scenarios – at the time you ask for a portfolio recommendation.

SquirrelSave DAAS uses data from reputable information providers. The data used include structured data such as fundamental/technical and unstructured data such as measures of market bullishness or bearishness.

SquirrelSave invests in ETFs listed in the USA exchanges.

Compared to other exchanges where ETFs are listed, the USA exchanges offer the most liquid, deepest and widest range of ETFs covering asset classes across the world.

Based on our theoretical investment models using back testing techniques over the period 1 Jan 2005 to 31 Mar 2019, the long-term annualised returns range from 11% for the lowest risk portfolio to 16% for the highest risk portfolio.

Yes, there is a USA withholding tax of 30 per cent on all dividends paid to non-US citizens/residents. This is the same tax exposure if you were to invest in any dividend paying USA-listed ETFs.

SquirrelCash is a temporary holding account for your monies. When you deposit into SquirrelCash, your monies are held pending allocation to fund a few SquirrelSave investment goals you set up. It gives you the convenience of depositing only once instead of multiple deposits to fund a few investments goals.

No, SquirrelCash is a temporary holding account for your money, pending your investment decision.

Currently, SquirrelSave does not accept joint accounts.

Usually, policies on employee investment restrictions are in place to address insider dealing or conflicts of interest concerns. These may involve dealing restrictions in securities where one has possession of material non-public information concerning such securities, or disclosures/approvals before dealing in securities.

SquirrelSave invests solely in Exchange-traded Funds ("ETFs") using AI-driven technology to execute investment decisions. ETFs are commonly excluded from such restrictions as the employee does not have control over the basket of securities underlying the ETF. While company policies may not distingush ETFs or exempt ETFs from dealing restrictions, it is adviseable to consult your relevant compliance/supervisor before opening your SquirrelSave account.

If needed, SquirrelSave will provide confirmaton in writing that the SquirrelSave account is a discretionary investment management service if your employer/organisation requires one to meet its compliance requirements.

Please contact us at clientservices@squirrelsave.com.sg if you have further queries.

The purpose of the Customer Knowledge Assessment (CKA) is to assess if you have the knowledge or investment experience to understand the risks and features of “Specified Investment Products” (SIP) - in particular, Exchange Traded Funds (ETFs), before SquirrelSave recommendations are made to you or before your SquirrelSave account is approved/activated.

SquirrelSave does not offer tax advice or tax planning services in our investment portfolios.

Global ETF portfolios invest in ETFs that are listed on USA stock exchanges. Hence, USD funds are required for settlement of such transactions. Accordingly, all non-USD currencies including SGD funds are converted into USD in order to invest.

All foreign currency conversions attract a cost. These currency conversion costs are imposed by third parties. SquirrelSave will work with such third-parties to mitigate these costs. In the case of SquirrelSave's appointed broker, Saxo Capital Markets has committed to fixing the cost of currency conversion at 10 basis points to be embedded in the applicable FX rate.

No. You are not required to open a Central Depository Account to start investing with SquirrelSave.

The definition of “Accredited Investor” (“AI”) is stipulated by the Singapore Monetary Authority (“MAS”) Section 4A(1)(a) of the Securities and Futures Act, Chapter 289 of Singapore (“SFA”).

[1] An individual's primary residence refers to where the individual lives in most of the time and is to be calculated by deducting any outstanding amounts in respect of any credit facility that is secured by the residence from the estimated fair market value of the residence; and is taken to be the lower of the following:

• the value calculated under paragraph (1);

• S$1 million.

[2] Where "financial asset" means:

• a deposit as defined in section 4B of the Banking Act;

• an investment product as defined in section 2(1) of the Financial Advisors Act, which includes securities, securities-based and other derivatives contracts, collective investment schemes, and life policies; or

• any other asset as may be prescribed by regulations made under section 341 of the Securities and Futures Act; or

[3] If all joint account holders individually qualify and have opted in for AI status, all joint account holders may be treated as an AI in respect of dealings through that joint account. For accounts where one or more joint account holders are non-AI, the joint account may be treated as AI if:

(a) at least one joint account holder is an AI and has opted in to be treated as an AI; and

(b) all joint account holders opt in to be treated as AIs in respect of dealings through the joint account only.

We are required under Singapore law to provide you with certain information before you decide on whether you wish to be treated as an Accredited Investor.

Even if we assess you to be an “Accredited Investor”, you may, but are not obliged to, consent to being treated by us as an Accredited Investor. You may withdraw your consent at any time, upon which we will cease to treat you as an Accredited Investor.

As an accredited investor, you will, among other things, be deemed to have more knowledge and ability to understand and manage the risks of the financial products that you invest in. We can assume that you have a certain level of understanding of financial products and are not obliged to determine your precise level of understanding of such products. We are also allowed to assume that you have sought independent advice prior to purchasing or participating in any financial instrument or investment. In addition, when you hold certain financial instruments or participate in certain activities, you will be afforded fewer statutory protections and remedies than retail investors.

"To be classified as an AI, you must opt-in by choosing the option presented to you in our account opening process to be identified as an “Accredited Investor”. This Accredited Investor Opt-In may be subject to our verification that you meet the prescribed requirements. To be clear, you may choose to be treated as a retail investor and avail yourself of the protection afforded by the relevant statutes such as the Securities and Futures Act (“SFA”) and the Financial Advisers Act (“FAA”).

Alternatively, you may complete and submit our opt-in form to clientservices@squirrelsave.com.sg

Yes, you can revoke your status as an Accredited Investor at any time simply by giving completing and submitting our “Accredited Investor Opt-In Withdrawal Form” to clientservices@squirrelsave.com.sg.

Your Accredited Investor Opt-In Withdrawal will take effect upon 7 working days after we receive your duly completed Opt-In Withdrawal Form.

However, subject to any rights, applicable terms and conditions, your account, investments, holdings and/or dealings prior to the Accredited Investor Opt-In Withdrawal becoming effective will not be affected. You can hold on to your existing investments.

Once your Accredited Investor status is revoked, we will not be able to offer you certain products and services that are deemed unsuitable for retail investors. We may not be able to assist you if you would like to receive further advice, purchase new investments, make new subscriptions, receive information or advice on new products or switch out existing investments and/or carry out any other transactions when or after the Opt-In Withdrawal becomes effective. For the avoidance of doubt, we will not be liable to you under any circumstances for any losses that you may suffer as a result of you opting out from being treated as an Accredited Investor.

The minimum age to open a SquirrelSave account is 18 years old.

If you are a Singaporean/Singapore PR, you will need to upload your NRIC during account opening.

If you are a foreigner, your passport is required. Documents to prove a valid address such as a utility bill is required if you are residing outside Singapore.

There is no minimum sum required to open a SquirrelSave account, but we would encourage you to start with at least S$15,000 (Singapore Dollars Fifteen Thousand) to take full advantage of our AI system capabilities.

Aside from US citizens and US tax residents, almost anyone can invest with SquirrelSave, subject to our client due diligence processes.

Go to www.squirrelsave.com.sg, complete the SquirrelSave Risk Profiler or decide your own risk profile. Submit an account online. We will email you an activation link once your account is approved.

Fret not. Simply play our proprietary SquirrelSave Risk Profiler game to assess your risk profile.

We require your personal information for verification purposes and to comply with the regulations pertaining to applicable laws. Your information is needed for our machine learning AI to analyze and construct the most suitable portfolio based on your risk profile.

Log into your account at www.squirrelsave.com.sg and set up at least one investment goal. Depending on the investment goal you set up, SquirrelSave may recommend the amount of savings required. Notwithstanding, you can decide to invest whatever amount you are comfortable with. Our system will generate a unique reference code and bank transfer instructions.

When SquirrelSave receives your money transfer to fund your chosen investment goal, SquirrelSave will email you that it has received your funds and will execute the necessary transactions based on latest updated portfolio. This is because SquirrelSave's machine learning AI predicted portfolio generated for you may have changed since between the first recommendation and the time SquirrelSave received your investment funds. The transaction orders will be sent to our broker-dealer for execution on the relevant market day, and failing which, on the next available market day.

There is no minimum balance to maintain and you are able to withdraw/redeem your investment(s) at any time.

No. You can withdraw/redeem your investment(s) anytime.

No. You can invest any amount you prefer. You can also deposit funds monthly or at any time. Our recommended amount is based on your investment goal and certain assumption. Ultimately, SquirrelSave is here to assist, and you have full discretion as to how much you wish to invest.

Yes, the CKA is needed in our client screening process.

For Singapore citizens and permanent residents, your tax identification number is your NRIC number.

For non-Singapore citizen and permanent residents, you can find your tax identication number on your tax returns.

SquirrelSave accepts online bank transfers. For regular savings, you can set up recurring deductions through your bank's online platform to fund your investment goal(s).

Yes, SquirrelSave DAAS has screened a select pool of ETFs which cover developed and emerging equities, fixed income, commodities and currencies.

Based on the investor's risk profile and entry timing, each investor will have a unique portfolio asset allocation composed of a selection from among the selected pool of ETFs.

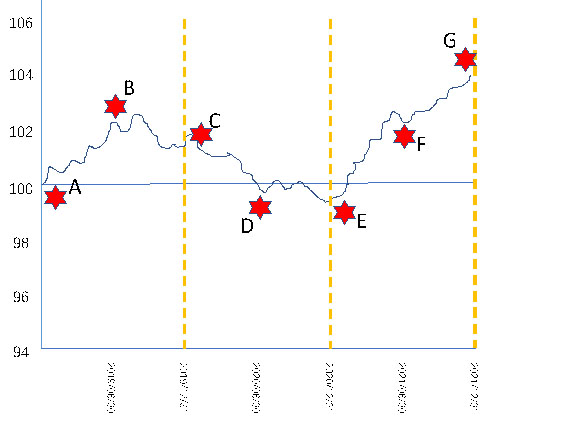

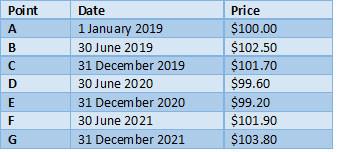

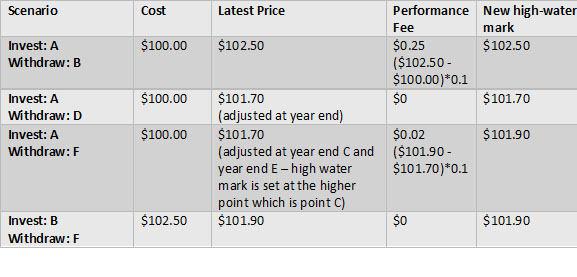

For each portfolio set up by you, our SquirrelSave Digital Asset Allocation System (“DAAS”) will generate an indicative NAV (that measures the value of your portfolio adjusted for inflow and outflow of investment money). The indicative NAV is a unit value method to distinguish the different cost entry whenever investment money is topped up/withdrawn during the calendar year.

Any dividends received will be credited to the cash allocation component of your investment portfolio, and will be reinvested at the next rebalancing.

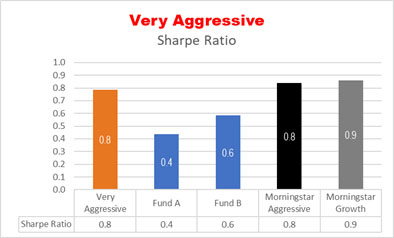

Yes. Every SquirrelSave portfolio that is recommended for you has a specific reference benchmark. The reference benchmark is based on an asset allocation that is within the probable asset class allocation ranges of your recommended portfolio. We assess the performance of your recommended portfolio by comparing the Sharpe Ratio and Max Drawdown with that of the reference benchmark. For an understanding of the Sharpe Ratio and Max Drawdown, please refer to the relevant section in our FAQ.

If your portfolio underperforms the adjusted high-water mark, any underperformance is tracked and has to be recovered by any subsequent outperformance before a performance fee can be accrued.

If there is already a performance fee accrual during the calendar year, the accrual will be reduced to reflect any subsequent underperformance, although this will not be reduced below zero. To be clear, where there is outperformance over the full calendar year which results in a performance fee being charged, and this is followed by underperformance in subsequent calendar years, there will be no refund of prior year performance fees.

As can be seen from the above illustration, the benchmark hurdle is applied to the high-water mark to calculate an adjusted high-water mark, which the net asset value must exceed before there can be an accrual of performance fees. Note that you may be subject to different performance fee accruals depending on holding periods/withdrawal dates.

Where this occurs and there is positive cumulative net excess return at the calendar year end, then a performance fee will be charged and the high-water mark/adjusted high-water mark will be reset to the net asset value (adjusted for cash top-ups and cash withdrawals) on the last calendar day of the year.

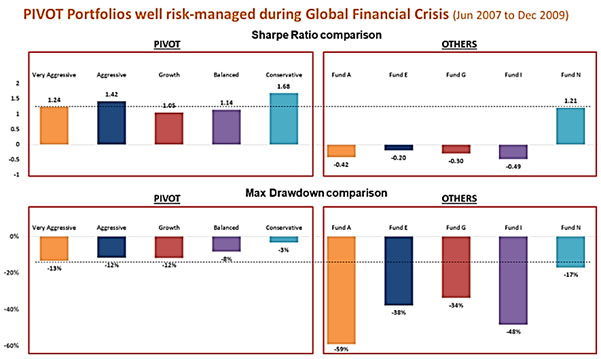

SquirrelSave manages each client’s investments separately. As such, SquirrelSave uses reference portfolios for 5 broad risk classes, namely Conservative, Balanced, Growth, Aggressive and Very Aggressive, to track performance.

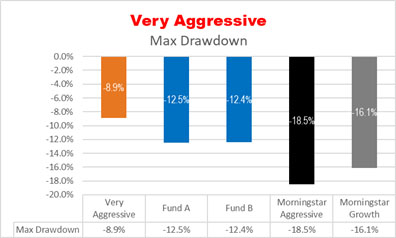

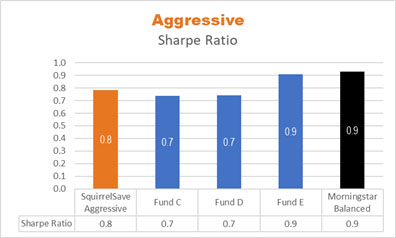

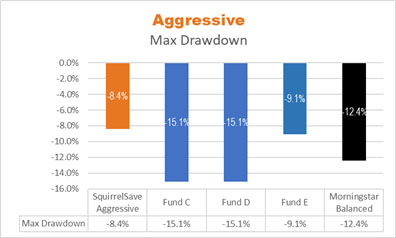

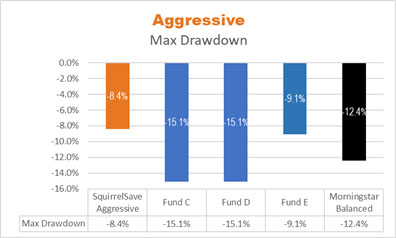

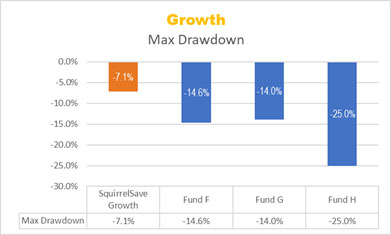

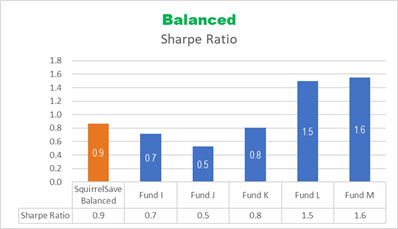

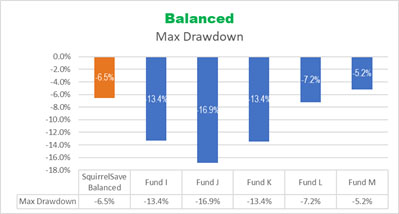

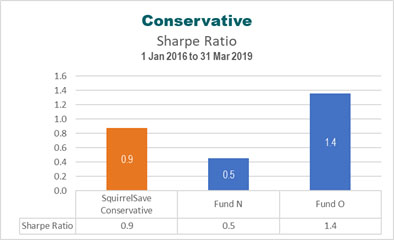

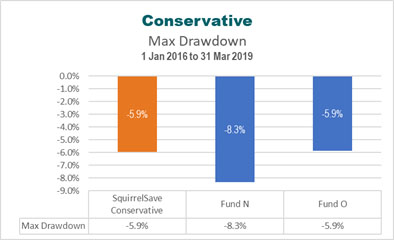

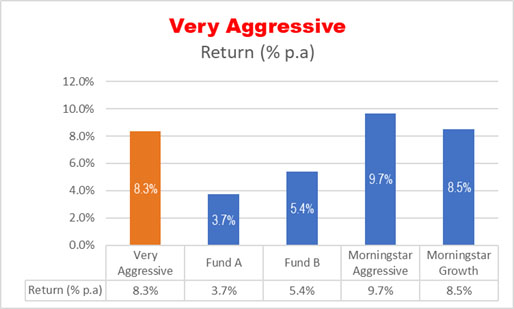

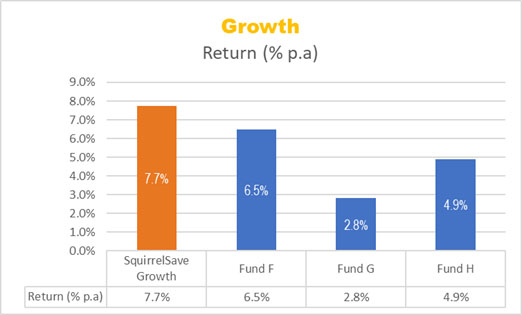

For each of the broad risk classes, we selected the top performing funds as well as available passive benchmark portfolios and compared them with our 5 reference portfolios using (i) Sharpe Ratio and (ii) Maximum Drawdown.

Sharpe Ratio measures the risky returns achieved per unit of risk taken. For maximizing returns, the higher Sharpe Ratio is preferred.

Maximum Drawdown is the measure of downside risk over the investment period. The bigger the Maximum Drawdown, the upside required to breakeven will be greater. Hence, the smallest Maximum Drawdown is desired.

The results clearly show that our SquirrelSave reference portfolios compare well and even beat the top performing funds and passive benchmark portfolios in terms of risk-adjusted returns and downside risk control.

Sharpe Ratio & Maximum Drawdown (Jan 2016 to March 2019)

All 5 SquirrelSave risk class reference portfolios (shaded orange) compare favourably with the respective top performing funds (shaded blue) as well as the passive benchmark portfolios (shaded grey and black).

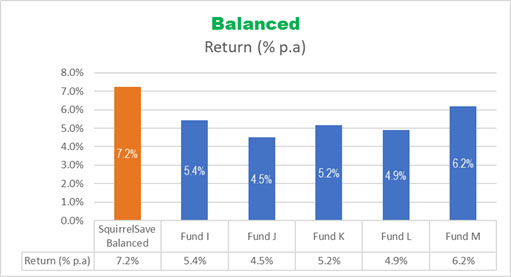

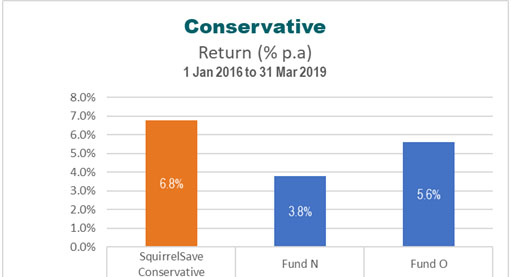

Absolute Investment Returns (Jan 2016 to March 2019)

The 5 SquirrelSave reference portfolios delivered commendable absolute returns (ranging from 6.8% for Conservative to 8.3% for Very Aggressive/Aggressive) against the top performing funds in the respective risk classes.

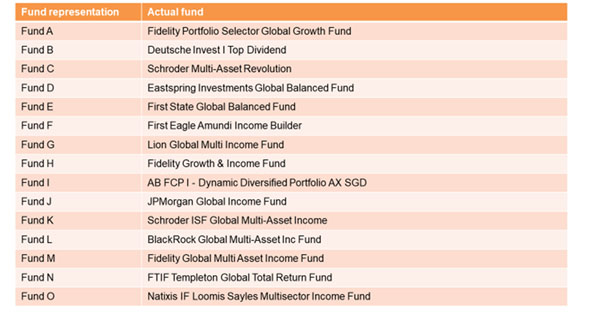

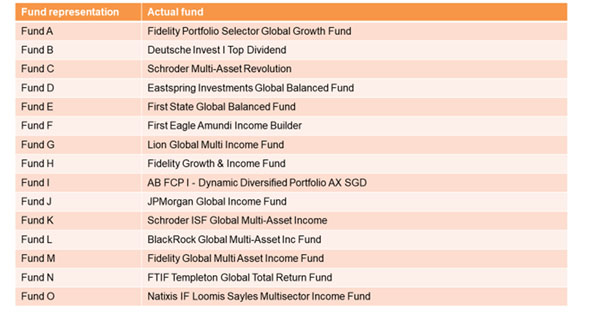

List of top performing funds used in the comparisons

In our simulations and back-testing, the SquirrelSave portfolios behaved very well in terms of riding the volatile markets. The Sharpe Ratio outperformed all the top performing funds and the Maximum Drawdown was well controlled by comparison.

List of top performing funds used in the comparisons

You can transfer money from/to your SquirrelCash to/from your personal bank account at any time. Likewise, you can transfer money from/to your SquirrelCash to/from your chosen investment goal at any time.

The unique reference code is tied to the specific investment goal you created. Funds received without the unique reference code will be parked in SquirrelCash. You can proceed to transfer funds from SquirrelCash to your chosen investment goal as desired.

Alternatively, please contact our customer service team at clientservices@squirrelsave.com.sg for assistance.

No. You can only top-up with the same currency that you used when you funded the goal for the first time. Similarly for withdrawal, you can only withdraw in the same currency as the goal.

Top-up the total amount you would like to fund into your goals into SquirrelCash (without quoting any reference code). Thereafter, go to My Account > + Deposit and allocate the desired amount to each and every goal.

You can transfer money into your SquirrelSave account from a bank account that is in your name via:

(i) Internet bank transfer (GIRO)

(ii) FAST transfer

(iii) Telegraphic transfer (subjected to bank charges)

SquirrelSave is not able to accept money from third-party sources.

SquirrelSave does not charge any fees for transferring money in or out of your SquirrelSave account.

If you deposit/withdraw in SGD to/from your Global ETF Portfolio, there will be a 10 basis point currency conversion charge by our broker, Saxo Capital Markets embedded in the FX rate.

If you deposit/withdraw in USD or any non-SGD currency to/from your Global ETF Portfolio, there are bank charges for sending and receiving Telegraphic Transfers ("TT") which you have to bear.

Yes, you can transfer funds from a joint bank account as long as you are one of the account holders.

It takes about 2-3 business days for your SquirrelSave account to be funded, unless there are other factors involved.

Withdrawal of funds will require about 2-5 business days before the funds are credited into your bank account.

We currently accept Singapore dollars only.

You can set up a recurring monthly or quarterly cash transfer to your SquirrelSave account via your personal online banking account. Add us to your payee list in your online bank account. Thereafter, set up a one-time and/or recurring deposit according to your planned investment goals.

Yes, you can. Simply login to your SquirrelSave account and submit the withdrawal request.

We will facilitate the withdrawal of your portfolio cash balance and/or liquidation of your portfolio assets, in full or in part, whichever applicable, as soon as practicable.

There are no fees, charges or penalties for withdrawal or full closure of your SquirrelSave account. However, all withdrawals are subject to payment of any accrued fees and charges, including performance fees.

Yes, as long as the bank account holder is in your name.

The unique reference code of a particular goal will be displayed when you initiate a deposit into the chosen goal.

Yes, we will send you email notifications for every transfer and withdrawal.

Your mobile number is used as login ID. Please contact our customer service team at clientservices@squirrelsave.com.sg when you have changed your mobile number. For security purposes, we will require two-factor authentication when authorizing the new mobile number.

We could assist to update your personal particulars. Please contact our customer service team at clientservices@squirrelsave.com.sg. For security purposes, we may request for supporting documents.

To reset your password, you can click on "forgot password" from the login page.

You may add and delete your bank accounts at My Profile > Manage Bank Account.

To close your account, please contact our customer service team at clientservices@squirrelsave.com.sg

No. The SquirrelSave Global ETF Portfolio is a discretionary investment service. The portfolio asset allocation is generated by our real-time SquirrelSave Digital Asset Allocation System ("DAAS"). As such, you cannot change the portfolio allocation.

The default reporting currency is Singapore Dollars (SGD).

You can view and/or download your monthly statement under [My Profile].

An ETF typically charges low fees of around 0.15% - 0.25%. In contrast, mutual funds and unit trusts are relatively more expensive, charging fees that range from 1.25 - 2.0%, sometimes more.

There are no fees to open a SquirrelSave account.

The Fees and Charges for the Global ETF portfolios are (i) Annual Management Fee (ii) Performance Fee.

(i) Annual Management Fee

0.50 per cent per annum - calculated and paid daily based on the daily average market value of portfolio assets.

(ii) Performance Fee

10 per cent of the annual absolute USD return with USD highwater mark, calculated based on each portfolio’s (goal’s) underlying USD value after each calendar year-end, and paid in arrears.

No. SquirrelSave does not charge you any sales, subscription, redemption, custodian, withdrawal penalty or closing fees. All such fees and charges, if any, are passed through to you and imposed by third-parties over whom SquirrelSave has no influence - although SquirrelSave has on a best effort basis to reduce such third-party fees and charges.

Fees are automatically deducted from your portfolio(s). The Annual Management Fee is deducted daily while the Performance Fee is deducted after each calendar year end.

At SquirrelSave, we want to align our interests with you. We only receive a Performance Fee when we generate a positive net excess return for you over the full calendar year, and with a highwater mark. This means we only get the Performance Fee when we really generate a return over the market cycles. We believe it also shows confidence in our long term performance.

Only where there is a positive cumulative net excess return at the calendar year-end or the end of your holding period (if shorter) subject to the highwater mark, will a Performance Fee become payable to us.

The Performance Fee is calculated as a percentage of the absolute return based on the original capital investment received (after conversion into the base USD value of the SquirrelSave account goal). The Performance Fee is calculated once a year, at each calendar year-end.

Our calculations track when your investment capital was first invested and does so for every tranche of investment capital invested subsequently – so that the Performance Fee is applied to each tranche you invested in USD terms, and only if there is an absolute positive performance in USD terms. This approach covers the scenario of any withdrawal (in part or full before the calendar year end) in any capital investment tranche because every such withdrawal will trigger a review of whether a Performance Fee on the amount to be withdrawn is applicable.

The highwater mark is the highest value that your portfolio has reached since its inception.

The Performance Fee calculation is accrued only when the USD highwater mark is exceeded. This ensures that a Performance Fee is charged only when any previous losses have been recovered. The highwater mark for each portfolio will initially be set equal to the USD value of the portfolio when you start.

When you enjoy a positive cumulative net return in USD terms at the end of the calendar year and a Performance Fee becomes payable to us, the USD highwater mark will be reset to the net asset value (after adjusting for any cash top-ups or cash withdrawals during the intervening period) on the last business day of the calendar year. However, if your portfolio in USD terms has not exceeded the USD highwater mark over the full calendar year, no Performance Fee will be charged and the USD highwater mark will remain unchanged from the previous year.

For each portfolio set up by the client, our SquirrelSave Digital Asset Allocation System (“DAAS”) will generate an indicative USD NAV (that measures the value of your portfolio adjusted for inflow and outflow of investment money). The indicative USD NAV is a unit value method to distinguish the different USD cost entry whenever investment money is topped up/withdrawn during the calendar year.

Whenever a withdrawal is made before the calendar year-end and when the calendar year-end arrives, the DAAS will calculate the Latest USD NAV (LNAV) and compare it with the Cost USD NAV (CNAV).

If LNAV > CNAV, then the Performance Fee will be charged. And if so, the LNAV is re-designated as the CNAV to ensure that any future Performance Fee is not duplicated (high-water mark feature). To be clear, there is no pro-ration of the Performance Fee if it is applied before the calendar year-end. .

If LNAV < CNAV, no Performance Fee is applicable. .

Where there is overlapping capital investment tranches involved when calculating the Performance Fee, our DAAS will adopt the “First-In, First-Out” principle.

If your portfolio underperforms the adjusted high-water mark, any underperformance is tracked and has to be recovered by any subsequent outperformance before a performance fee can be accrued.

If there is already a performance fee accrual during the calendar year, the accrual will be reduced to reflect any subsequent underperformance, although this will not be reduced below zero. To be clear, where there is outperformance over the full calendar year which results in a performance fee being charged, and this is followed by underperformance in subsequent calendar years, there will be no refund of prior year performance fees.

Saxo Capital Markets Pte. Ltd. ("Saxo") is our appointed broker-dealer and custodian for the ETFs. Hence, the Global ETFs are technically held and owned by Saxo. PIVOT Fintech Pte. Ltd. (SquirrelSave's legal entity) is a beneficiary of Saxo. As a client and Global ETF investor of SquirrelSave, you are beneficiary on our Portfolio Accounting ledger. Therefore, you are the owner of the ETFs in your Global ETF Portfolio(s).

To ensure that we never touch your money, we use custodian banks that hold your money, whether it's in cash or in securities. Your money and investment assets are kept entirely separate from SquirrelSave's operating finances and assets.

Your Global ETF Portfolio(s) underlying ETF and cash investments are held by Saxo as the custodian.

Your money deposited with SquirrelSave is received and held by UOB Bank Singapore as the custodian.

Therefore, you will always have full access and claim to your cash and investment assets if SquirrelSave closes down, gets acquired, goes public or whatever happens.

We have a secure server infrastructure hosted on Amazon Web Services with 24/7 intrusion detection and other security measures. Our systems are audited and tested by third-parties to guard against cyberattacks with regular security code reviews and penetration testing.

Yes, we do. As a SquirrelSave client, you must set up two-factor authentication (2-FA) when creating your account. When you log in from a new device or update your account, 2-FA will require you to enter a One-Time-Password (OTP) sent via SMS.

FATCA is a USA law to enforce US tax laws on US persons using non-US accounts. Under FATCA, financial institutions in Singapore are to carry out reviewing procedures and disclose financial account information of account holders who are US Persons to the Inland Revenue Authority of Singapore (IRAS). You may refer to the US IRS for more information on FATCA.

The Common Reporting Standards (CRS) is an international agreement endorsed by the Organisation for Economic Co-operation and Development (OECD) for automatic exchange of financial account information in tax matters to deter an detect tax evasion through the use of offshore financial accounts. You may refer to the OECD or IRAS for more information on Common Reporting Standards (CRS).

The CRS requires financial institutions of participating jurisdictions to identify their account holders who are tax residents of other reportable jurisdictions. Relevant account information of these account holders would be reported to the local tax authorities, who would in turn exchange the information with the tax authorities of the participating jurisdictions where the account holders are tax residents.

You may refer to the Rules Governing Tax Residence published by the different jurisdictions. Alternatively, check with the tax authority of the jurisdiction which you think you may be a tax resident or consult a tax adviser.

Under the Singapore FATCA and CRS regulations, we are required to establish the tax residency status of all our customers. However, for accounts opened by individuals who are only Singapore tax residents, we are not required to report your information to the IRAS.

We may ask you for a copy of your passport or other government issued documentation to verify your identity or confirm your self-declared tax residency.

If there is any change in the information you have provided to us, you should inform us immediately so that we can discuss with you whether any other action is required. If you do not provide the requested certification, we may be required to report your details based on information available in our records to the relevant tax authority.

We are committed to being fully FATCA-CRS compliant. Hence, we will not be able to open new accounts or serve customers who choose not to comply with requests for documentation to establish status under FATCA-CRS.

In many cultures, it is common to give presents or even monetary gifts on special occasions. Sometimes, it is hard to think of a suitable gift. Will the recipient like it? Or does the recipient already have the gift I am giving?

SquirrelSave’s AI-driven investment portfolios are an excellent gift idea.

Compared to traditional gifts, an investment portfolio can grow with time. Instead of a gift that will suffer wear and tear over time, SquirrelSave’s Gift-a-Portfolio will grow with time and help encourage greater planning for the future by investing early.

You can Gift-a-Portfolio from as little as ONE Dollar! With such a small sum to start, you don’t have to wait for a special occasion!

It’s meaningful to nudge someone to start saving early. Be different! Instead of giving monetary gifts on festive occasions, Gift-a-Portfolio with SquirrelSave!

Gift-a-Portfolio to Anyone, Anywhere, Anytime!

The Gift-a-Portfolio is managed by SquirrelSave’s AI machine learning system 24/7. It is hassle free for the recipient as there are no day-to-day decisions to make. All the hard work is done by SquirrelSave.

You are gifting a global SquirrelSave investment portfolio which comprises Exchange Traded Funds (ETFs) diversified across multiple asset classes.

Yes. You decide what type of SquirrelSave portfolios to gift by choosing the risk setting. SquirrelSave will create and invest in the latest portfolio at the time your recipient claims and accepts your gift. This means your recipient enjoys the power of our SquirrelSave AI investment engine which is updated 24/7.

Yes. SquirrelSave is not a trading engine, but an asset allocation service. We take a medium to long term view of at least one year. You can decide to set a minimum investment period for your Gift-a-Portfolio. One year is a good start although a longer period will allow the SquirrelSave investment more time to ride out market volatility.

As SquirrelSave clients need to be at least 18 years old, you should Gift-a-Portfolio to the parent or legal guardian of the intended recipient.

There is no cost for you to send a Gift-a-Portfolio. Unless otherwise specified or provided for in the case of any marketing promotions, the recipient will be levied the SquirrelSave fees and charges upon acceptance of your gift like any other SquirrelSave client investment.

Upon confirmation that your Gift-a-Portfolio is rejected by your intended recipient, the Gift-a-Portfolio amount will be refunded into your SquirrelCash component of your SquirrelSave account, usually within 3 to 4 business days.

Yes. Gift-a-Portfolio has a 14-calendar day period starting from the send confirmation and the end of which the intended recipient must confirm acceptance. If acceptance is not confirmed by the end of the 14-calendar day period, the Gift-a-Portfolio is deemed to be rejected and will be refunded to you as the giver into your SquirrelCash component of your SquirrelSave account.

Yes. You as Giver, will receive confirmations both via SMS to your mobile number as well as to your designated account email upon your recipient’s acceptance of your gift.

You can Gift-a-Portfolio to as many recipients as you like, one submission at a time!

No. The Minimum Investment Period will be locked in after your recipient accepts your Gift-a-Portfolio.

Your recipient will be free to do what they wish with the gifted investments after the minimum investment period expires, including ability to do full withdrawal, shift to another investment with a different risk setting or transfer to his/her SquirrelCash component of the SquirrelSave account.

MoneyBox is our cash management solution offering enhanced returns versus bank savings and fixed deposit accounts. It offers higher yet safe returns by investing in a combination of specially selected UOB Asset Management (UOBAM) funds. You can deposit any amount without restrictions or withdrawal penalties. It can also be held conveniently until you’re ready to shift into other SquirrelSave goals created for longer term needs.

It’s comprised of an allocation of 70% UOB United SGD Fund Class B Acc and 30% UOB United SGD Money Market Fund Class B. The Funds and allocations are reviewed and assessed annually with changes made if warranted to maintain or enhance risk adjusted returns.

No, you are free to invest strictly in MoneyBox as long as you wish, without any obligation to invest in another goal for your SquirrelSave account.

It takes about 3-4 business days for deposits to appear in your SquirrelSave account (barring unforeseen factors), depending on the timing of your deposit. Faster processing is offered for transfers before 5pm on a given business day. Withdrawals typically take 5-6 business days to reach your bank account, barring unexpected occurrences.

We pool your deposits with other MoneyBox investors to get preferential access to UOBAM’s institutional fund classes. These classes offer lower underlying management fees versus those charged to retail investors.

SquirrelSave management fees and other fees are currently waived for MoneyBox. This waiver will be reviewed annually and clients will be informed with sufficient notice if and when a decision is made to apply our usual 0.1% annual management fee.

There is no minimum lock-in period or other restriction for your MoneyBox investment. We offer an attractive projected return, based on a widely accepted methodology that is subject to periodic review. In contrast, bank savings accounts typically offer very low fixed returns with no fixed minimum balance. They pay higher rates on a tiered basis (albeit still lower than MoneyBox), subject to progressively rising minimum deposit thresholds. Some banks offer promotional returns, pegged to minimum credit card charge levels, but may also be subject to lock-up periods with fee penalties for early withdrawal.

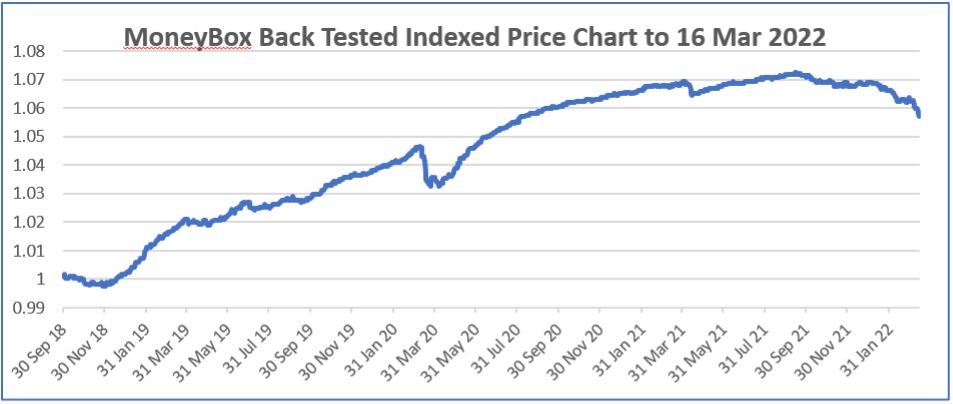

According to internal data analytics compilations, which are subject to periodic review, MoneyBox has displayed an annualised volatility that has ranged between 0.6% and 0.9%.

Yes, expected returns can vary as market and economic conditions change over time. Ongoing reviews will be conducted and adjustments, if any, will be disclosed shortly afterwards.

No. Your SquirrelSave goals fees are charged on an individual basis while MoneyBox typically imposes a minimal 0.1% annual management fee (currently waived).

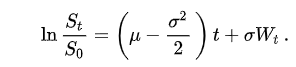

Projected returns are compiled using a widely accepted quantitative model for projecting asset price movements and returns; namely, the Geometric Brownian Motion (GBM) formula, as shown below:

After MoneyBox’s underlying fund returns are compiled using the GBM formula, a blended net projected return is calculated. This is done by applying the weights of the 2 underlying funds; 30% for UOB United SGD Money Market Fund Class B and 70% for UOB United SGD Fund Class B Acc. (net of all fund level expenses). As no trailer fees (rebates) are received from the funds’ managers, no further adjustments are required. A summary illustration of the Net Projected return is shown below:

| Projected Return Calculation | |

|---|---|

| Gross projected return p.a.1 | 1.2% to 1.5% |

| Overall trailer fee rebates2 | 0.00% |

| SquirrelSave management fees | WAIVED3 |

| Net projected return p.a.1 | 1.2% to 1.5% |

This model is reviewed and updated periodically along with the projected return, if necessary, using the above methodology.

A further illustration of the potential returns MoneyBox can generate is shown in the below 3-year simulated price chart using back-tested pricing data.

Just like other SquirrelSave goals you set up, you can set up a recurring monthly, quarterly or annual transfer to MoneyBox via your personal bank account. Add us to your payee list in your online bank account, then enter your desired recurring deposit amount and one of the above frequencies.

DoGood is a social investing idea developed by PIVOT Fintech Pte. Ltd. (201716150D), a Singapore incorporated company with registered address at 60 Paya Lebar Road #11-25 Singapore 409051 (“PIVOT”).

PIVOT is a Licenced Fund Management Company regulated by the Monetary Authority of Singapore (“MAS”) and operates a digital AI-driven investment system called “SquirrelSave”.

DoGood is a crowd investing service to benefit a specified cause or Beneficiary with the aim of growing cash donations received by investing globally using SquirrelSave’s AI-driven investment engine over a given time period.

DoGood is a micro philanthropic initiative where you can gift investment portfolios to help someone build a financial nest egg for their future.

There is a need to offer cash donations that grow with time, and which can meet future needs.

Currently, donations are primarily made in cash. Often, the beneficiaries who receive cash donations need guidance on how to use the money wisely. Many who receive more cash than is needed do not know how to safekeep the excess cash or save for the future. Cash donations may not match needs, especially in the years ahead.

SquirrelSave DoGood was created and designed to meet future financial needs especially for low-income families where there may be someone who will not be able to look after oneself when the parents pass on, with few or no relatives who can step in.

SquirrelSave started DoGood to make it easy for anyone anywhere to invest anytime for someone deserving and who can benefit from the proceeds in the future.

Cash donations address current needs. SquirrelSave DoGood addresses future needs.

The typical parties involved are:

DoGood focuses on building a nest egg for future needs. For example, DoGood is suitable for situations where there is a low-income family with a child suffering from Down Syndrome or other dilapidating conditions. Such afflictions may include cerebral palsy or other intellectual and/or physical disabilities that limit self-care or require additional care in the future adult years (when the current caregivers may no longer be able or pass away).

DoGood will screen causes recommended by Sponsors and will select Beneficiaries with priority given to low-income families.

SquirrelSave will do a background check on history, current situation and future needs, including available family support and resources. SquirrelSave will also assess current and future sources of financial assistance available. Generally, SquirrelSave’s DoGood eligibility for onboarding, among other factors, is a cap on per capita household income of SGD1,000 per month, with exclusions considered for household members deemed as removed or not relevant.

A Guardian is nominated by the immediate family of the Beneficiary.

DoGood is powered by the SquirrelSave AI-driven investment engine which uses AI to invest globally and to manage risks 24/7 by diversifying across multiple investment assets based on statistical probabilities of future risks versus returns – which is humanly impossible.

The default setting is mid-risk or “Growth”. SquirrelSave consults with the Beneficiary and/or Guardian/Sponsor before making the final decision.

Yes, the default is set at 5 years. However, SquirrelSave will consult with the Beneficiary and/or Guardian/Sponsor before making the final decision.

That’s it.

Currently, there are none.

DoGood is essentially a SquirrelSave Gift-a-Portfolio sent to a specified cause or Beneficiary. Once you DoGood for a Beneficiary, the legal ownership of DoGood investment monies is transferred to the Beneficiary.

As the Beneficiary becomes the legal owner of the DoGood investment, the reports are sent to the Beneficiary or to the appointed Guardian on behalf of the Beneficiary. The DoGooder will see a list of causes or Beneficiaries that have been adopted.

When the MIP ends, the investment is unlocked and the Beneficiary and/or Guardian as the case may be, can:

The Guardian will take over and hand control to the legally appointed administrator of the Beneficiary’s estate, whether legally nominated previously for the Beneficiary, or by the State post.

Last updated on 23 Mar 2022.