SquirrelSave Reference Portfolios riding out short term volatility

Feb 5, 2022

Volatile start to 2022 for both equity and bond markets

As we shared in our 2022 Investment Outlook, investment markets would be largely driven by:

- US Federal Reserve Taper

- Global Supply Chain Bottlenecks

- China’s Economic Performance

1. US Federal Reserve

In Jan 2022, markets reacted to the US Federal Reserve intent to raise interest rates to combat rising inflation. US January CPI was stronger than expected at 7.5%, the highest since 1982. This raised market volatility, made worse by slowing tech earnings momentum. For example, Meta (Facebook), PayPal and Amazon, among others, caused spikes in single-day S&P 500 stock volatility of as much as 65%, the highest single-day reading since the USA presidential election results on 9 Nov 2020.

We expect more central banks to normalize monetary policy as post-pandemic recovery begins. In Jan 2022, the Bank of England raised interest rate for the first time in over three years to tackle surging price rises.

2. Global Supply Chain Bottlenecks

Iron ore prices rose on the back of China’s 2030 deadline for peak emissions in the steel industry. Oil prices jumped on renewed fears of a Ukraine-Russia conflict.

The global supply bottlenecks show no signs of abating. Continued mayhem at factories, ports and warehouses put upward pressure on prices. In late Jan 2022, the International Monetary Fund (IMF) cited supply chain woes for downgrading its 2022 global economic growth forecast from 4.9 percent to 4.4 percent.

3. China’s Economic Performance

In Jan 2022, China unexpectedly cut its interest rate for the first time in two years as its economy slowed. GDP grew by 4% year-on-year in the final quarter of 2021, much slower than the previous quarter. We are watching two developments:

- China’s property sector which accounts for 25 percent of GDP is attracting less investment and faces a looming debt crisis.

- Reduced consumer optimism and weaker retail sales than expected with China's strict zero Covid policy lockdowns in Jan 2022 stemming from the Omicron variant.

How did the volatility impact SquirrelSave Reference Portfolios in January?

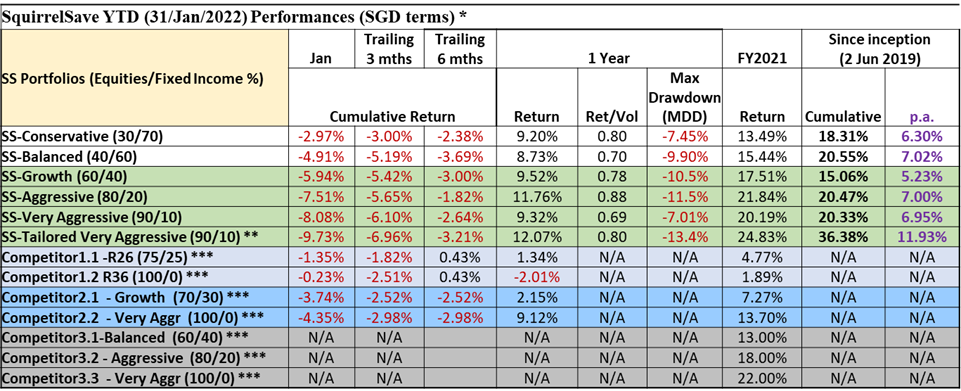

In Jan 2022, our SquirrelSave reference portfolios experienced negative returns of -3% to 9.7% due to the sharp correction of the USA tech sector. The Nasdaq Composite index fell 9% in Jan 2022.

Despite the Jan 2022 pullback, SquirrelSave reference portfolios outperformed over the time period of six months and longer. This is in line with our expectations given that SquirrelSave is designed as an investment AI, and not a short-term market trading algorithm.

Nonetheless, our quantitative investment team is closely monitoring your portfolios to manage the drawdowns and position for upside once the market stabilizes.

* Inclusive of ETF expense ratios and net of SquirrelSave management fees. SquirrelSave uses AI to design and manage diversified investment portfolios for each investor. Because SquirrelSave is not an investment fund, there is no single return measure. Instead, every SquirrelSave investor has his/her own investment performance as each investor is managed separately by our SquirrelSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SquirrelSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

** Single portfolio investment amount more than SGD15,000

*** Performance numbers for competitors are estimates.

# Ret/Vol refers to the ratio of Investment Returns over Volatility (or Risk)

We remain confident in riding the volatility for medium to longer term returns

We expect increased volatility in 2022. With our machine learning approach, we aim to squeeze longer term returns with no human emotion or short-term market timing. Even as rates normalize, real interest rate remain low due to rising inflation. We see post-pandemic recovery ahead with above average GDP growth in developed markets, low unemployment rates and sustainably high corporate earnings. These support the case for investing and managing the SquirrelSave portfolios efficiently to manage downside risks for the market upturn.

Regards,

SquirrelSave AI Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

5 Investing Insights & Strategies From Chinese New Year Games

Team SquirrelSave

Gambling is a huge part of the Chinese New Year festivities. Pick up some investment knowledge while enjoying these popular CNY games!

Read more

3 Smart Ways to Grow Your Child’s HongBao Money

Team SquirrelSave

Financial literacy and saving for a rainy day is a life skill that you, as parents, should start teaching your young children.

Read more

SquirrelSave - Looking Ahead as we begin 2022

Team SquirrelSave

Is the market going to crash again like when Covid caused global panic in Feb 2020? Will the USA Federal Reserve move to start increasing interest rates crash the markets? You get the picture.

Read more