Investment Lessons from SquirrelSave Portfolios’ Strong Growth in July 2022

2 Aug 2022

Lesson 1: Focus on Medium to Long Term when Investing

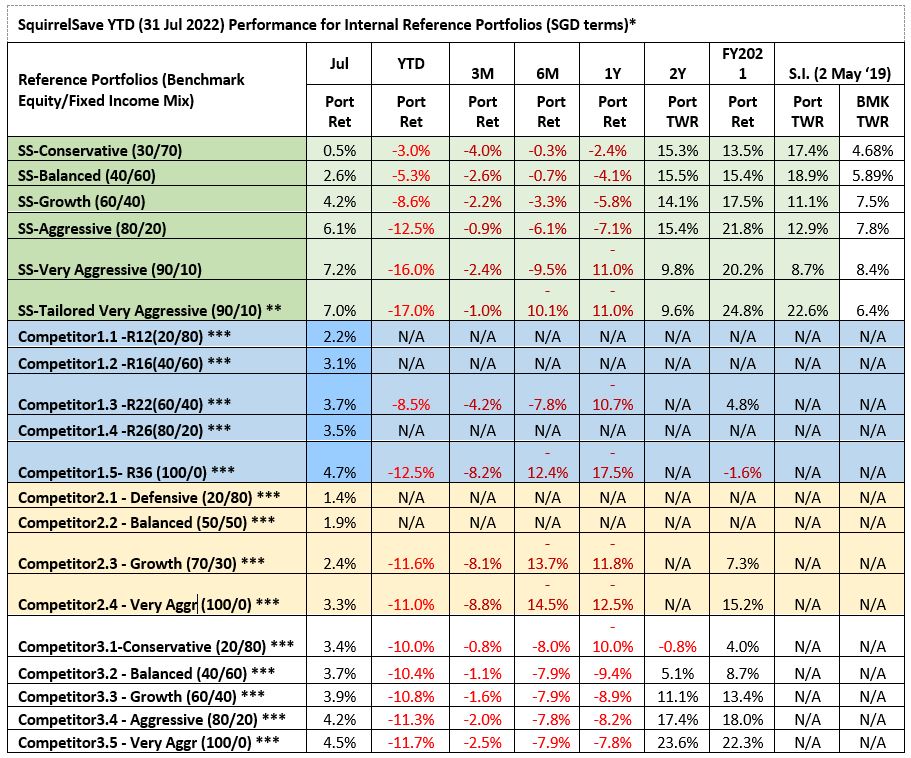

While our lower risk portfolios did very well in the first few months of 2022, our mid to higher risk reference portfolios registered strong positive returns in July 2022.

On a one-year basis, all SquirrelSave portfolios (except the “Very Aggressive”) beat the competitors.

Taking a short-term view is trading – not investing. If you sold your portfolio near recent market lows, you likely would have missed the rebound.

We are confident that our Very Aggressive portfolio will catch up. As a higher risk portfolio, it needs to ride out market volatility to generate returns. Our Very Aggressive portfolio did well in 2021. Hence, it is not surprising for it to remain exposed to the current heightened risk environment.

To learn more, read our blog, “Stay Invested & Reap Better Returns”.

Table 1

* Inclusive of ETF expense ratios and net of SquirrelSave management fees. SquirrelSave uses AI to design and manage diversified investment portfolios for each investor. Because SquirrelSave is not an investment fund, there is no single return measure. Instead, every SquirrelSave investor has his/her own investment performance as each investor is managed separately by our SquirrelSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SquirrelSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance. ** Single portfolio investment amount more than SGD15,000 *** Performance numbers for competitors are estimates. Abbreviations: BMK: Benchmark; EQ: Equity; FI: Fixed Income; Ret: Return; TWR: Time Weighted Return; Vol: Volatility; MDD: Maximum Drawdown

Lesson 2: Our Disciplined Quant Investing avoids Human Emotions

Our quant-driven machine learning engine is performing well. Human emotions do not support consistent investment decisions. Read our blog, “During this Heightened Market Volatility, a Disciplined AI-Quant driven Approach is Better” to learn more.

Lesson 3: Choose Your Appropriate Risk Setting

You must accept volatility when investing. Volatility or “risk” is where investment returns come from. Read more at “Getting It Right: Realised and Unrealised Gains/Losses”.

Looking Forward…

We expect market volatility ahead. If markets suffer a pullback, we are confident our disciplined quant approach will mitigate any downside.

However, our data analytics suggest a higher probability that markets will move up further by year end. In such a scenario, we are confident that our reference portfolios will do well.

Regards,

Victor Lye BBM CFA CFP®

Founder & CEO / Chief Investment Officer

SquirrelSave AI Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

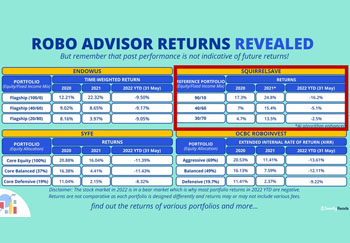

SQUIRRELSAVE INVESTMENT PERFORMANCE STANDS OUT AMONG THE REST

Team SquirrelSave

In a 6th July 2022 6th July 2022 seedly.sg comparison of digital advisers, SquirrelSave’s investment performance (in red box) is overall relatively better than the others.

Read more

During this Heightened Market Volatility, a Disciplined AI-Quant driven Approach is Better

Team SquirrelSave

The month of May is a sea of red for investing. This follows a “brutal April”. Almost everyone and everything is down, except inflation of course!

Read more

EMERGING FROM A BRUTAL APRIL 2022…

Team SquirrelSave

Our SquirrelSave AI algorithms have steered our lower risk reference portfolios to show positive returns of 1.9% to +2.5% for the trailing 3 months & +0.6% to +4.2% for trailing 12 months up to 30 April 2022. This is remarkable given how most other competitors have shown negative returns for the same periods.

Read more