Getting It Right: Realised and Unrealised Gains/Losses

April 7, 2020

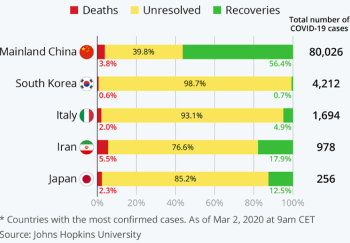

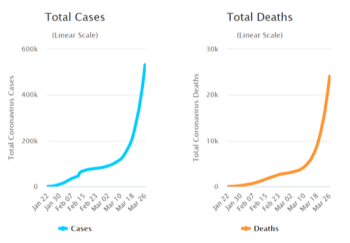

Fear still lingers as the world continues to grapple with Covid-19

In my simplest explanation, so-called investing behaviour is driven by greed and fear. This results in gambling-like behaviour. Currently, fear rules.

So as in typical gambling behaviour, people are mostly heading for the exits because they have lost everything (including what they had won previously) or have cash but are too afraid to step in. This is mainly observed for the mom and pop gamblers.

But swankier gamblers (like professional stock traders) are trading on short term market movements (volatility, also a measure of “risk”) while the real professional investors are slowly picking up depressed assets for a time horizon of typically more than one year.

Understanding Realized and Unrealized Gains/Losses

While I use gambling and investing analogies to differentiate between trading and investing behaviours, it is important to note that in gambling, losses are real losses and winnings are actual winnings. In investing, what you see is just the current market value (commonly called “Net Asset Value” or “NAV”) of your investments.

NAV can go up. NAV can go down.

Human emotions tend to be good when we see NAV higher than our initial investment (our capital). We feel lousy when we see NAV below our capital. Some don’t even want to look when NAV is down – like an ostrich. Hey, it’s ok. I’ve been there too. But we need to know better.

NAV is just a number in investing.

Unlike gambling when the losses and winnings you hold are real, the NAV will fluctuate according to the market and real-world conditions. Until you decide to buy (enter) or sell (exit) the investment market, the NAVs are just numbers. When you buy or sell, you make the NAV real or actual – in the sense that you get paid or pay the NAV in real money.

So, if you see the markets down, and your current investment NAV is below your capital, you don’t have to make it real unless you decide to exit (sell) your investments. In the same way, you can make the current NAV real by buying at the current low values. Hence, the NAV is only realized when you buy or sell. Otherwise, the NAV you are looking at simply indicates the “unrealized” gains/losses. It’s just a number for now.

Under today’s market conditions, almost all investors are staring at “unrealized” losses. If we think the NAV may possibly be higher in the future, there is a chance that the NAV will exceed your capital resulting in “unrealized” gains.

What can you do?

If you are currently invested, you are probably staring at “unrealised” losses. If you have selected the suitable risk profile and time horizon for your investment, stay the course. This current Covid-19 is a common infection for all, and anyone invested. No one is immune - pardon the pun!

If you have not, you need to pay more attention to the investing risks you are able to take.

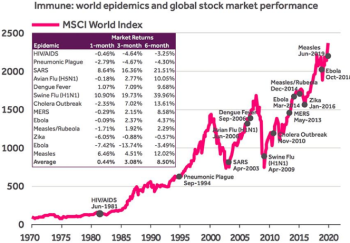

If you are not currently invested, this current Covid-19 crisis is an opportunity. Read my previous blog on “Is Covid-19 different from the past crisis?”.

Don’t waste a good crisis for investing longer term.

Check out SquirrelSave from the comfort of your homes (and thrones)!

Meanwhile, stay home and stay healthy!

Under Singapore’s “circuit breaker” from 7 April to 4 May 2020, SquirrelSave is still operational though our office is closed.

Being a fully AI-driven digital investment manager, our team members have been working from home for the last 3 weeks. As a digitally enabled business, our machine learning AI works 24/7, never sleeping. As the human stewards, our SquirrelSave team continues to review and fine-tune our business parameters – whenever we’re awake. Yes, be assured - even as we begin the month-long “circuit breaker” in Singapore.

Take care and stop gambling! Start investing smart!

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing.

More Articles more

Covid-19: Has Fear Run Ahead of Markets?

Team SquirrelSave

Greed and fear are the driving forces behind buying and selling decisions. We buy when there is an excessive greed. We sell when there is an excessive fear.

Read more

Covid-19: Defining Your Investment Experience

Team SquirrelSave

The IMF is forecasting a global recession in 2020. On the bright side, some analysts are forecasting a recovery as early as the third quarter of 2020.

Read more

Is Covid-19 different from the past crisis?

Team SquirrelSave

Yes, Covid-19 is different from the causes of previous crises. There is deliberate policy-induced economic contraction – unlike other crises.

Read more