STAY INVESTED & INVEST REGULARLY

6 Oct 2022

A growing sense of despair seems to be taking hold across world markets as fears of recession abound, induced by the US Federal Reserve Bank’s aggressive interest rate hikes to fight inflation. Year to date until end September 2022, the S&P 500 and NASDAQ Composite Indices have reached bear market lows of -24.8% and -32.4%, respectively.

What can you do as an investor to protect your portfolio against further financial turmoil?

In times like these, its useful to take a step back and reflect on what occurred during past global downturns. During the last major recession – the Global Financial Crisis (GFC) of 2008-2009, for example, a significant bear market drawdown was followed by one of the most powerful bull-runs in recorded history. Investors who panicked and sold their investments during the GFC missed out on monumental gains.

The main lesson is that when we witness a market downturn, a recovery will follow. Therefore, it is crucial for us to realise what happens during recessionary periods so we can better capitalise on the inevitable market recoveries and significant opportunities they present.

Recessions are a natural occurrence of any economic cycle. While triggers can vary from cycle to cycle, all recessions are characterised by a drop in GDP value amidst slowing consumer demand or trade, eventual job losses and a general reversal in corporate profits.

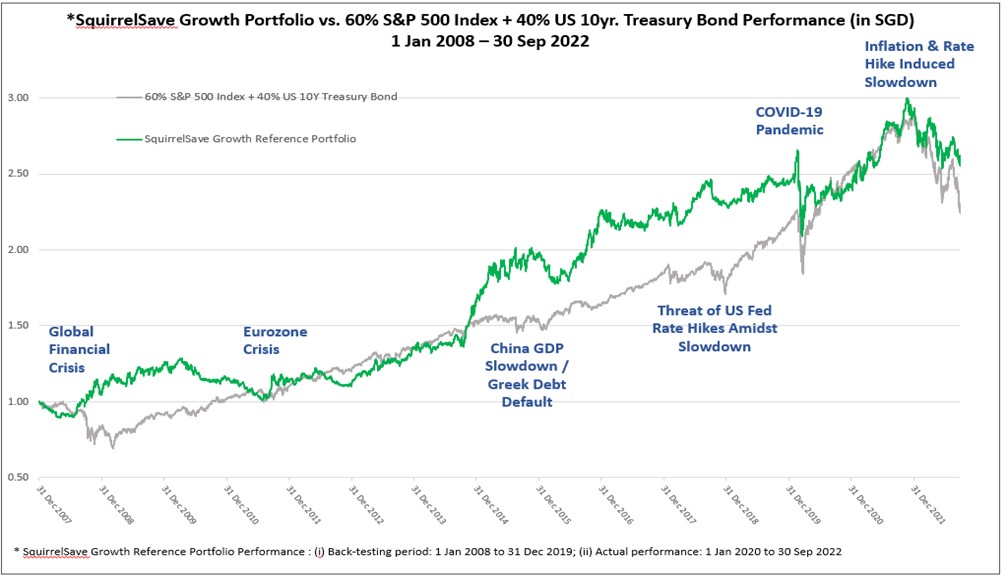

Typically, market traders try to anticipate or “factor in” a coming recession through large market selloffs. Assessing how deep or long a recession will be is challenging. However, note that recessions are always followed by economic recovery, typically resulting in a strong market rebound. This is well reflected in Chart A, which plots performance of major asset classes against simulated performance of our SquirrelSave Growth reference portfolio.

Chart A – SquirrelSave 60/40 Reference Portfolio During Economic Booms and Busts (2008-2022)

Source: Yahoo Finance and Internally compiled data

*Representation of long-term simulated and actual performance of SquirrelSave Growth Reference Portfolio (60% equity / 40% fixed income neutral mix). Performance is inclusive of underlying ETF holdings’ expense ratios but only net of SquirrelSave management fees for actual performance period (1 Jan 2020 – 30 Sep 2022). SquirrelSave uses AI to design and manage diversified investment portfolios for each investor. Because SquirrelSave is not an investment fund, there is no single return measure. Instead, every SquirrelSave investor has his/her own investment performance as each investor is managed separately by our SquirrelSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SquirrelSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

Lessons from Recession Driven Market Downturns

- Larger declines are usually in equities and less in bonds due to higher risk traits of the former.

- Investing using a combination of equities and bonds in a portfolio helps smoothen deep market ups and downs.

- Long-term performance can be enhanced by letting SquirrelSave’s AI and Machine Learning (AI/ML) approach to investing do the heavy lifting for you!

While it is difficult to forecast exactly how much longer or how low the current market decline will go, relying on SquirrelSave’s dynamic algorithmic approach removes our human guessing. This is well proven through Chart A which shows that time in the market (via our SquirrelSave portfolios) is better than trying to time the market’s ups and downs.

Even in this market downturn, the negative returns are unrealised (until you give up and sell). You can hold and ride the inevitable recovery. If you have available investable money now, you can invest regularly using the tried and tested approach of Dollar Cost Averaging (DCA). By following the DCA strategy, you reduce your average entry cost over time versus a lump sum investment. DCA allows you to invest at lower prices in market downturns. Once the markets bottom, as they always do, you’ll be even further ahead towards meeting your ultimate financial goals. Better still, adopt DCA with our fully automated SquirrelSave investment portfolio!

What else is SquirrelSave doing to protect your portfolios amidst prevailing market uncertainty?

Our algorithms recognised the adverse trends and occurrences impacting markets in recent months. We monitored our system and noticed that our AI shifted asset allocation towards the defensive side of our portfolios.

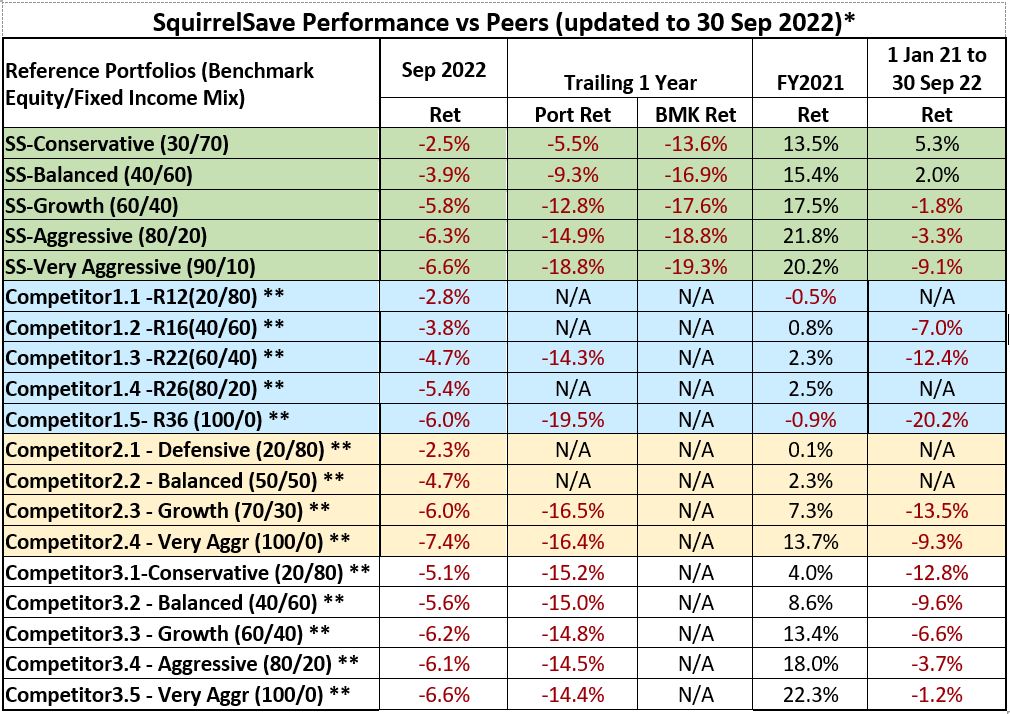

Our approach is to manage risks using AI/ML. In this respect, our algorithms have done well based on the trailing one-year performance (see table below).

* Inclusive of ETF expense ratios and net of SquirrelSave management fees. SquirrelSave uses AI to design and manage diversified investment portfolios for each investor. Because SquirrelSave is not an investment fund, there is no single return measure. Instead, every SquirrelSave investor has his/her own investment performance as each investor is managed separately by our SquirrelSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SquirrelSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance. ** Performance numbers for competitors are estimates. Abbreviations: BMK: Benchmark; Ret: Return.

- On a past 1 year basis, our reference Conservative risk portfolio is managing downside well at -5.5%, while Competitor #3 delivered -15.2%.

- For the mid-risk reference portfolio, SquirrelSave’s Growth portfolio shows -12.8% while in comparison, Competitor #1 delivered -14.3%, Competitor #2 delivered -16.5% and Competitor #3 delivered -14.8%.

- In the high-risk category, SquirrelSave is behind on a one-year trailing basis. We are not surprised due to its strong outperformance in 2021. This is the expected downswing for such an aggressive risk portfolio, and we are confident that the portfolio will recover ahead of the market.

It is timely to stress that SquirrelSave is not a trading or speculative algorithm. SquirrelSave’s AI/ML system is quantitatively designed to focus on the medium to longer-term investment time horizon. With SquirrelSave’s dynamic asset allocation, we remain comfortable with the range of portfolio outcomes though the higher risk portfolios could do better.

Looking forward, we expect the market will continue to be volatile in the short term. Despite another market down month, we are confident that our reference portfolios will outperform their benchmarks as they are currently, when markets bottom and recover. Stay invested and invest regularly.

Yours sincerely

Victor Lye, BBM CFA CFP®

Founder & CEO

SquirrelSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SQUIRRELSAVE CONTINUES TO FOCUS ON ASSET ALLOCATION TO MANAGE LONGER TERM RISKS

Team SquirrelSave

Our algorithms are not focused on short term monthly movements, but we monitor closely. That said, August was a poor month for our algorithms. Even then, we focus on more than one month as our algorithms are not designed to be trading oriented. Our data analytics for investing focus on at least a one-year time horizon.

Read more

Investment Lessons from SquirrelSave Portfolios’ Strong Growth in July 2022

Team SquirrelSave

While our lower risk portfolios did very well in the first few months of 2022, our mid to higher risk reference portfolios registered strong positive returns in July 2022.

Read more

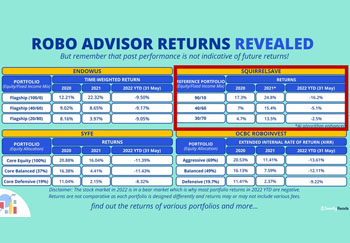

SQUIRRELSAVE INVESTMENT PERFORMANCE STANDS OUT AMONG THE REST

Team SquirrelSave

In a 6th July 2022 6th July 2022 seedly.sg comparison of digital advisers, SquirrelSave’s investment performance (in red box) is overall relatively better than the others.

Read more