3 Smart Ways to Grow Your Child’s HongBao Money

Jan 19, 2022

Financial literacy and saving for a rainy day is a life skill that you, as parents, should start teaching your young children.

If you celebrate Chinese New Year, then the custom of giving cash “hongbao” or “red packets” is a good opportunity to teach kids about money management.

Parents can introduce the concept of saving and spending by showing young children how you apportion their hongbao money into ”spend” and “save” jars. For example, 70% goes into the “save” jar while the child can spend the remaining 30%. This teaches them to prioritise saving while providing a reasonable reward.

However, instead of leaving the hongbao money stagnant in the “save” jar, parents can actively grow the hongbao money for their children in three ways: a bank savings account, insurance endowments and investing.

Bank savings account

This is a safe traditional option to grow their money in a passive manner. But with low interest rates and rising inflation, you may actually be losing rather than growing your money.

Insurance endowments

Endowment insurance plans are locked up for many years until your child reaches a certain age. While it provides insurance protection, returns are likely to be eroded by high insurance charges and sales commissions. The minimum entry amount is also in the thousands.

Investments

With investing, the myth is that you need a large sum of money and good investment knowledge to start. The truth is to start early.

Any experienced investor can tell you that investing early, with regular top ups and staying invested for a longer time should see better returns than waiting to accumulate a large sum and timing the market.

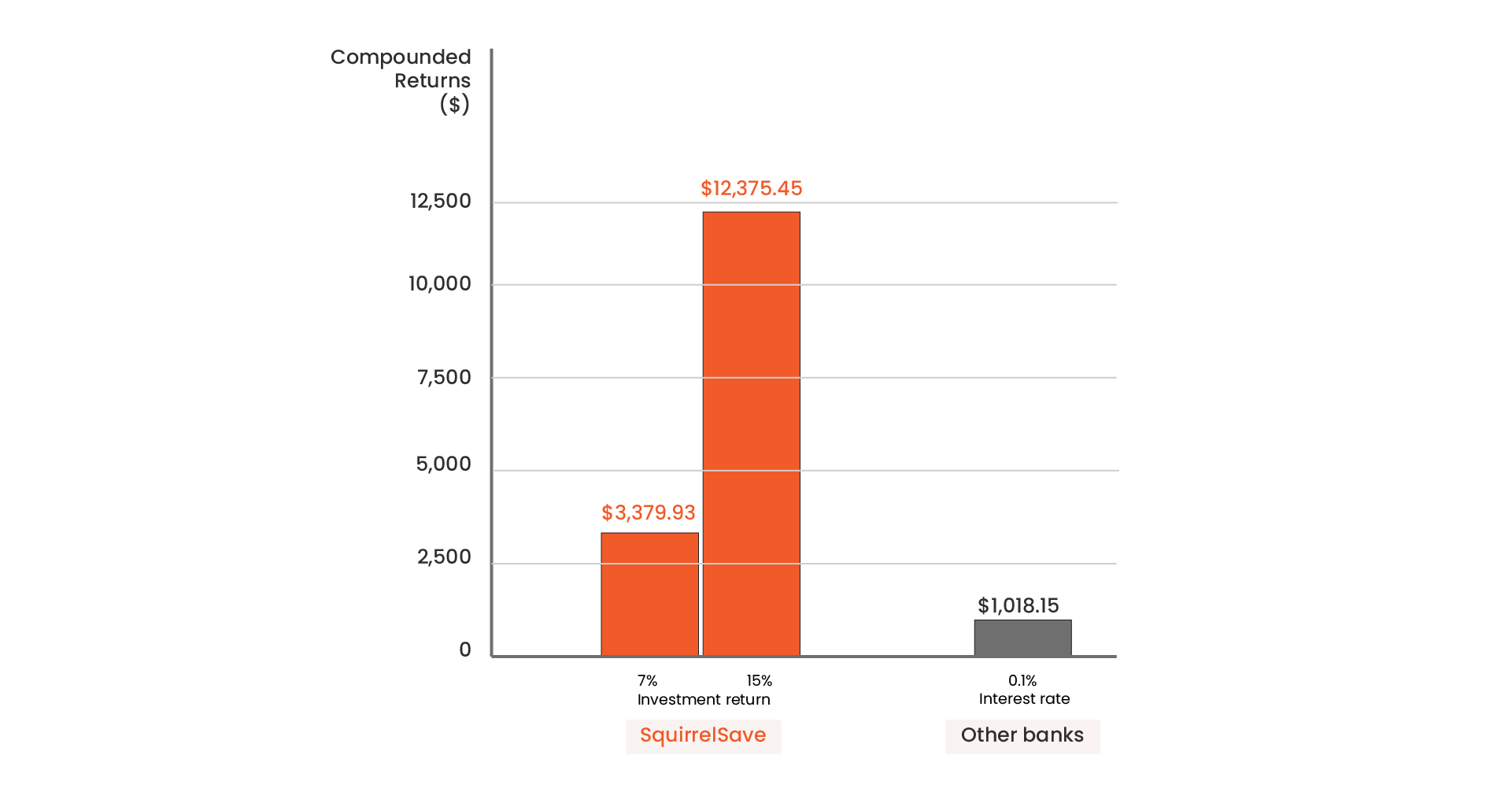

Investing early will capture the power of compounding returns. For example, if you invest $1,000 for a young child and assuming 7-15% returns, it will grow to $3,379.93-$12,375.45 after 18 years! Surely, that’s better than the traditional savings account?

SquirrelSave AI Investing

The good news is that with SquirrelSave’s AI investment system, you can invest your children’s hongbao money early, starting from just ONE Dollar.

SquirrelSave MoneyBoxTM

The low risk SquirrelSave MoneyBoxTM is a viable alternative if you want better returns than a traditional savings account and are willing to take just a bit of risk. SquirrelSave MoneyBoxTM is a cash management solution which targets enhanced returns compared to traditional banks or fixed deposit accounts. Find out more here.

SquirrelSave AI Global Investments

If you can accept higher risk for potentially better returns over the medium term or longer, then personalised SquirrelSave’s global investment portfolios will be worth considering.

SquirrelSave AI does what human investors cannot do. It removes emotion, and is 100% data-driven, working 24/7.

Regulated by the Monetary Authority of Singapore (MAS), SquirrelSave is designed by experienced quantitative investment professionals to make institutional investment knowledge and technology simple and available to you, starting from ONE Dollar.

SquirrelSave is a risk-managed AI-driven system that uses dynamic asset allocation to spread out your investment amounts into various asset classes – to diversify your portfolio and reduce investment risk. SquirrelSave is not a high risk short-term trading system.

Especially for parents who have little time and energy to do your own in-depth research, SquirrelSave’s AI investment system works 24/7 to analyse market trends and optimise your portfolio for the highest probable returns for your risk profile.

Unlike other robo-advisors, SquirrelSave’s platform is 100% AI-driven, has no minimum investment to start, zero lock-in, withdrawal or deposit anytime, and can be monitored via web or mobile.

Sign up in minutes if you use Singpass. Once your SquirrelSave account is open, you can set various risk profiles for different investment goals (or portfolios).

Teaching money management is essential but doesn’t have to be intimidating. Let SquirrelSave handle the heavy lifting while you show your children the value of investing with easily trackable returns through the SquirrelSave app.

For children aged 18 or more, empower them to manage their own investment with SquirrelSave’s Gift-a-Portfolio.

P.s For parents who are looking to get started with SquirrelSave, we have a special treat for you!

Take part in our TikTok challenge to guess how much is in our SquirrelSave jar to stand a chance to win an $888 Gift-a-Portfolio!

Find out more on our TikTok account here. Hurry, the contest ends on 14 February 2359!

Even better, don't wait till CNY to start investing! Begin your journey to financial freedom with SquirrelSave today by visiting us here

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SquirrelSave - Looking Ahead as we begin 2022

Team SquirrelSave

Is the market going to crash again like when Covid caused global panic in Feb 2020? Will the USA Federal Reserve move to start increasing interest rates crash the markets? You get the picture.

Read more

SquirrelSave ONE Dollar Reference Portfolios

+12% & +17% during Jan-Dec 2021

+19% & +31% in 18 months since May 2020

Team SquirrelSave

SquirrelSave offers global portfolios from as low as ONE Dollar. No more excuses!

Read more

SquirrelSave Reference Portfolios Outperform Significantly in 2021

Delivered +14% to +25% Returns for whole year 2021

Team SquirrelSave

December 2021 saw jittery markets as the US Federal Reserve signaled an end to monetary easing. Inflation fears continue. Omicron threatened more infection waves.

Read more