Ending 2023 With A Bang: SqSave Portfolios Outperformed and Ready For 2024

4 January 2024

FY2023 has been an excellent year for our SqSave reference portfolios, with the majority of our portfolios beating or being on par with the benchmark. The following is a brief recap for 2023.

Despite the high interest rate environment, financial markets ended 2023 strongly, with equities rallying in the fourth quarter. Concerns regarding US recession waned as earnings remained strong throughout the year and the Federal Reserve’s dovish remarks during the recent FOMC meeting. Technology stocks led the way as generative AI became one of the hottest topics. From the introduction and expansion of ChatGPT, the development of Microsoft co-pilot to content and video generation, companies are rushing to incorporate some form of AI in their workflow. Amidst the euphoria, caution should also be exercised due to the tensions from geopolitical events.

As we look forward to 2024, some of the notable events to consider are the Federal Reserve’s decision on interest rates, core inflation, and later in the year, US elections. Members of the Federal Open Market Committee indicated at least 3 rate cuts in 2024. The decisions were made mainly based on the reduction in core inflation, from as high as 5.71% in January to 4.01% in December 2023; as well as a softening labour market. In addition, the Federal Reserve faces an unsustainable interest expense in the current environment. Although the timing of the rate cuts is uncertain, it suggests the end of rate hikes. Moreover, as inflation approaches the Federal Reserve’s targeted rate of 2%, there would be no reason for further rate hikes.

Regardless of the headwinds and tailwinds, we believe that our risk-focused AI-driven SqSave investment algorithm design will be capable of adapting to the dynamic macro environment to capture returns while maintaining our risk appetite.

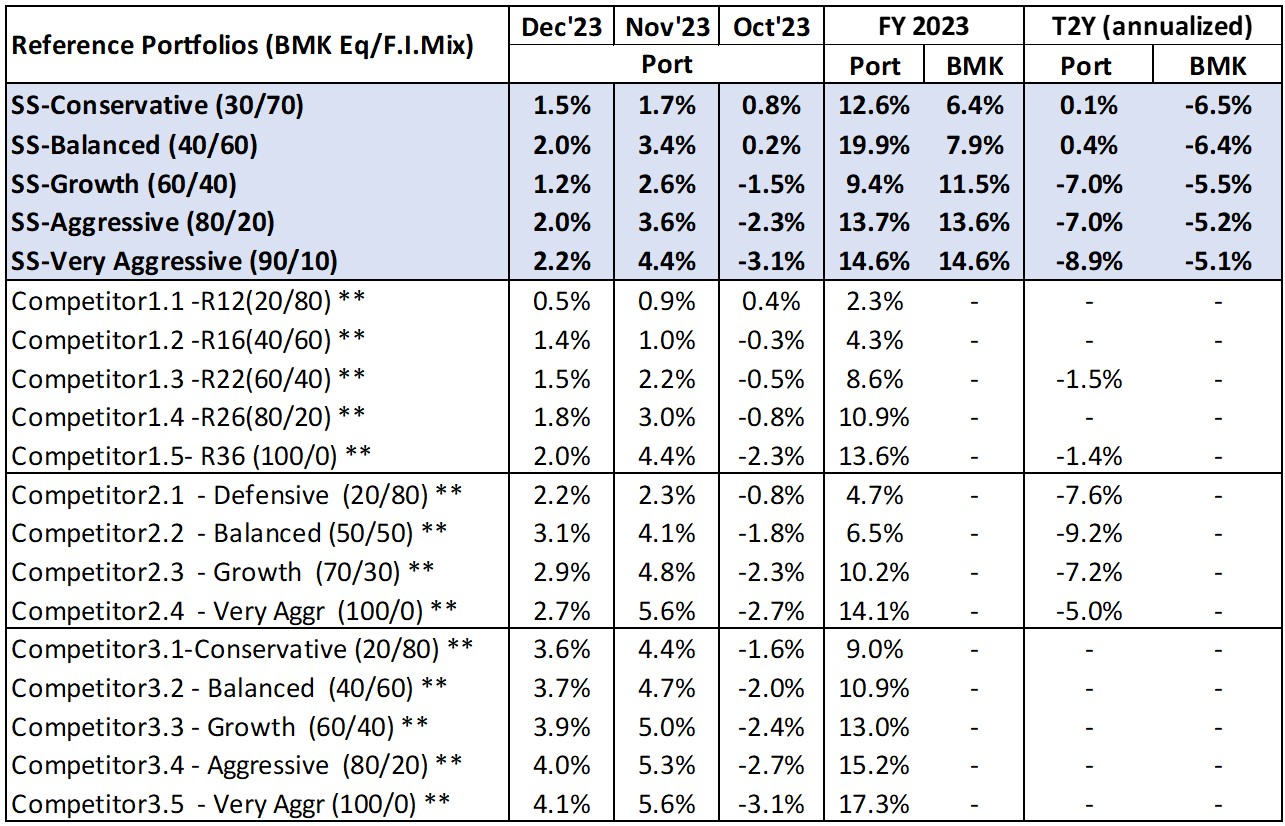

Importantly, for FY 2023, most of our SqSave reference portfolios generally performed well against benchmarks and peers as presented in the performance table below:

SqSave Reference Portfolios Returns Summary (SGD terms as at 31 Dec 2023)*

*Inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance. ** Performance numbers for competitors are estimates. Abbreviations: BMK: Benchmark; Ret: Return, T2Y: Annualized Time Weighted Return

Key Takeaways:

- FY2023: SqSave's portfolios (especially our low-risk ones) continue to outshine our benchmarks and competitors

- Trailing Two Year (T2Y): Our lower-risk portfolios have recovered from their 2022 drawdown and outperformed our benchmarks, while our high-risk portfolios are lagging. We expect a more robust performance in the coming months as our algorithms adjust with the new data.

Navigate Your Financial Future with SqSave

It would have been an ideal moment to consider SqSave before the November 2023 upturn. However, as markets evolve, staying invested to ride out the ups and downs is crucial for growth. Whether planning for retirement, acquiring your dream home, or growing your financial assets, SqSave offers a competitive blend of proven expertise and strategic insights.

Yours sincerely

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Riding the Wave of Change: SqSave Portfolios Demonstrate Resilience and Growth Amid 2023's Market Fluctuations

Team SqSave

As in 2022, the year 2023 has been volatile for both equities and bonds. November, however, was a stellar month.

Read more

SqSave's 2023 YTD Returns Continue to Outshine Benchmarks & the Competition

Team SqSave

Global equities continued their rollercoaster ride In October, buffeted by elevated US Treasury bond yields, geopolitical tensions, and a mixed corporate reporting season.

Read more

SQSAVE RESILIENCE IN THE FACE OF MARKET TURBULENCE

Team SqSave

This year has been a rollercoaster for global markets. But even in the face of challenges, SqSave continues to stand out with our proven strategy and steady performance. Let’s delve into our performance for September 2023.

Read more