Majority of SqSave’s Portfolios Outperformed Peers over Past 2-Years!

13 Dec 2022

As we approach the end of calendar 2022, we highlight how our SqSave algorithms have managed the lower risk portfolios under heightened market volatility.

Our data shows that on a trailing 2-year basis, our lower risk SqSave reference portfolios have outperformed their benchmarks and most of our peers. See the following SqSave risk-managed portfolios:

- Conservative

- Balanced

- Growth

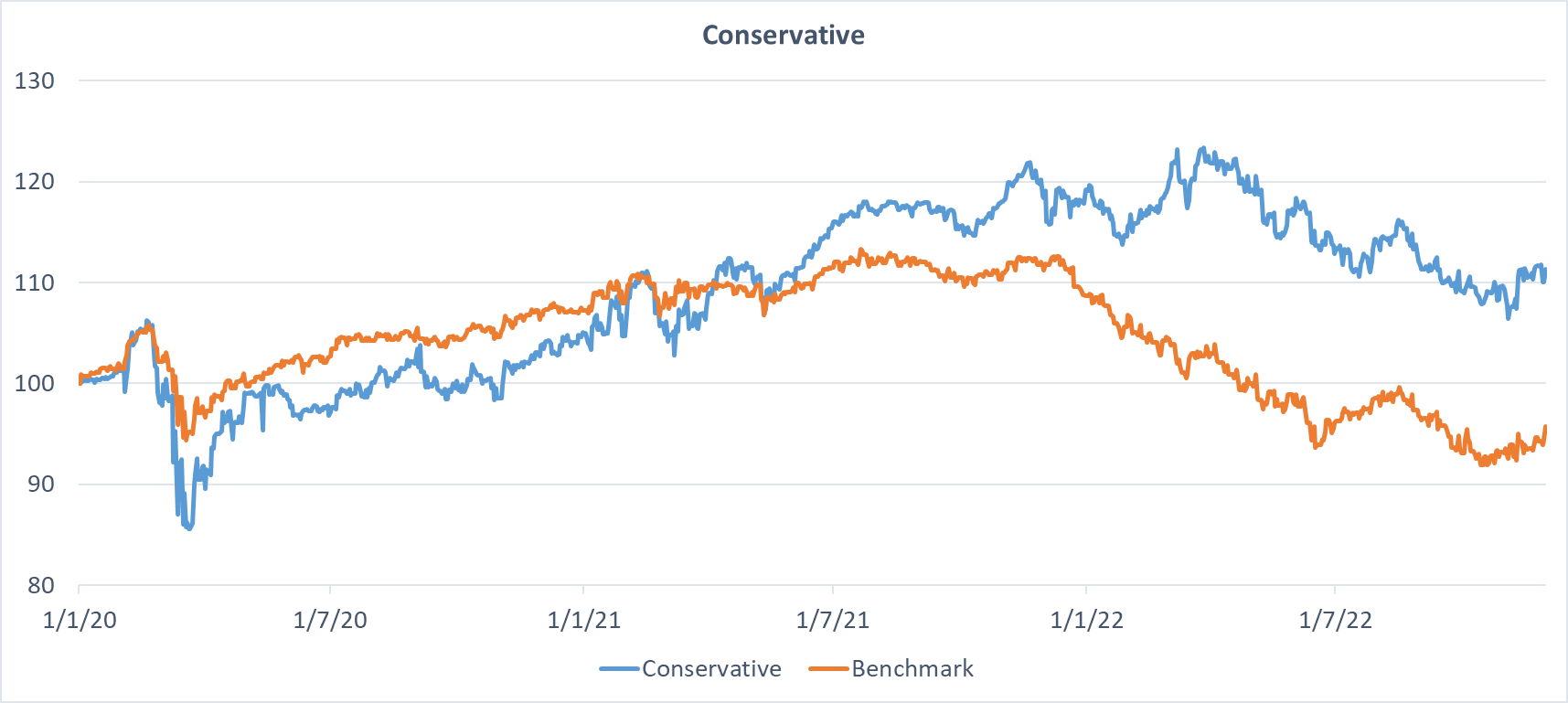

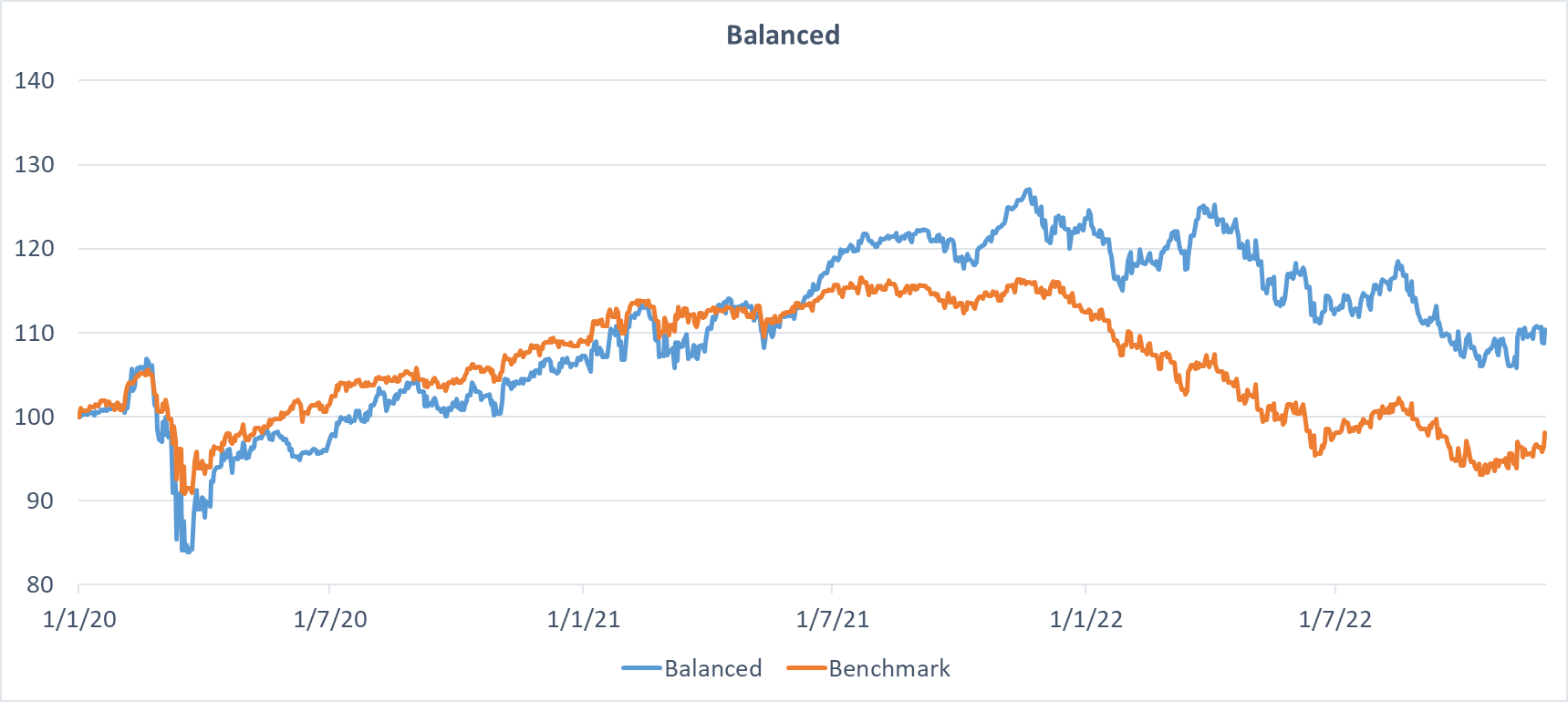

SqSave’s Conservative Reference Portfolio

SqSave’s Conservative Reference Portfolio vs Benchmark* SGD NAVs (1 Jan 2020 to 30 Nov 2022)

SqSave’s Conservative Reference Returns vs Competitors** (SGD terms as at 30 Nov 2022)

* Conservative Benchmark (BMK): 70% BNDX, 19% EEM & 11% VTI

** Performance numbers for competitors are estimates

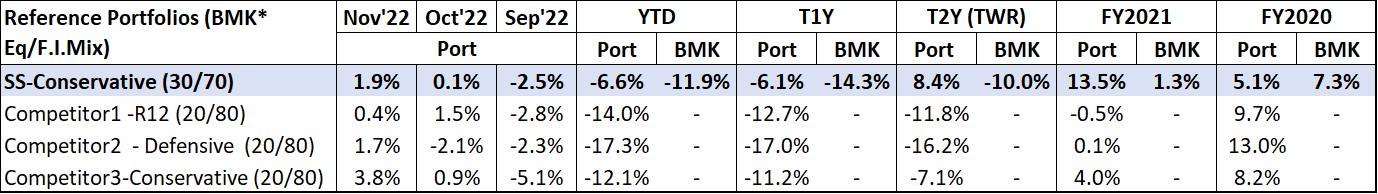

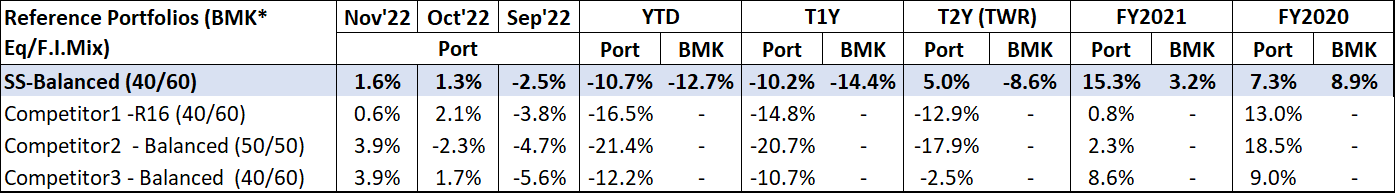

SqSave’s Balanced Reference Portfolio

SqSave’s Balanced Reference Portfolio vs Benchmark* SGD NAVs (1 Jan 2020 to 30 Nov 2022)

SqSave’s Balanced Reference Returns vs Competitors** (SGD terms as at 30 Nov 2022)

* Balanced Benchmark (BMK): 58.3% BNDX, 26.1% EEM & 15.6% VTI

** Performance numbers for competitors are estimates

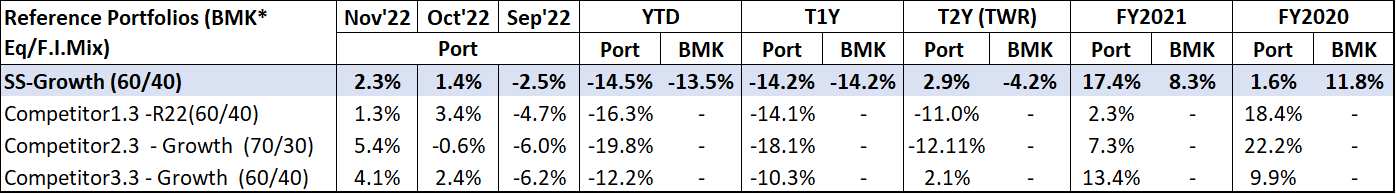

SqSave’s Growth Reference Portfolio

SqSave’s Growth Reference Portfolio vs Benchmark* SGD NAVs (1 Jan 2020 to 30 Nov 2022)

SqSave’s Growth Reference Returns vs Competitors** (SGD terms as at 30 Nov 2022)

* Growth Benchmark (BMK) Allocation: 40% BNDX, 30% EEM & 30% VTI

** Performance numbers for competitors are estimates

Looking Forward

On a trailing 2-years’ basis, our SqSave Conservative, Balanced and Growth reference portfolios have overall outperformed by beating their respective benchmarks and our peers. Our SqSave Aggressive and Very Aggressive portfolios are lagging in the last two months. Our higher-risk portfolios are designed to exhibit higher volatility over short to medium-term periods with expectations for higher returns over the long term. For now, we remain focused on riding out the market volatility.

Our short-term forward-looking indicators were mostly showing transient signals before the latest US Federal Reserve Bank (Fed) interest rate decision. The Fed hiked its benchmark rate by 50 basis points on 14 Dec as the market expected and we expect the market volatility to trend down albeit at a heightened level. With further clarity on the Fed’s inflation fighting strategy and China’s continued re-emergence from its zero-COVID restrictions, volatility is likely to revert to its mean. Therefore, we expect to see an eventual sustainable recovery in the long term.

Accordingly, we feel it is an opportune time to top-up investment exposure to your SqSave portfolios with a lump sum deposit or by following a dollar-cost averaging approach.

Yours sincerely

SqSave Quantitative Investment Team

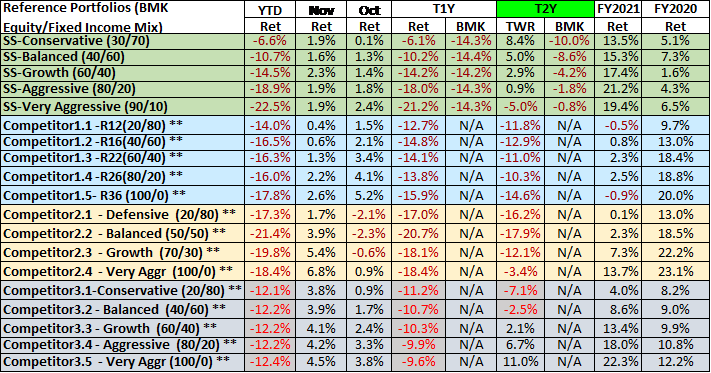

Appendix: SquirrelSave Performances vs Peers (SGD terms as at 30 Nov 2022)*

*Inclusive of ETF expense ratios and net of SquirrelSave management fees. SquirrelSave uses AI to design and manage diversified investment portfolios for each investor. Because SquirrelSave is not an investment fund, there is no single return measure. Instead, every SquirrelSave investor has his/her own investment performance as each investor is managed separately by our SquirrelSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SquirrelSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance. ** Performance numbers for competitors are estimates. Abbreviations: BMK: Benchmark; TWR: Time Weighted Return; Ret: Return.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

2023 MARKET OUTLOOK

Team SquirrelSave

We are dealing with extended anxiety in recent months. So far this year, the S&P 500 was down over 25% percent at its lowest closing level on 12 Oct 2022.

Read more

SquirrelSave Outperforms Benchmarks over Past 1Y & 2Y Periods

Team SquirrelSave

On a longer-term trailing 1 and 2-year basis, SquirrelSave’s returns have mostly outpaced their benchmarks. In particular, our low to mid-risk portfolios have outperformed their benchmarks by 22.4%, 18.3%, and 10.4%, respectively. Following yet another month of wild market gyrations, SquirrelSave’s reference portfolios managed to recoup some of their year-to-date downbeat performance.

Read more

STAY INVESTED & INVEST REGULARLY

Team SquirrelSave

A growing sense of despair seems to be taking hold across world markets as fears of recession abound, induced by the US Federal Reserve Bank’s aggressive interest rate hikes to fight inflation. Year to date until end September 2022, the S&P 500 and NASDAQ Composite Indices have reached bear market lows of -24.8% and -32.4%, respectively.

Read more