Stop Paying

for Bad Performance

November 1, 2019

Updated on January 1, 2020

What to do when you see people being fleeced every day?

In the investment world, those who have more money pay the lowest fees. Those who have less money to invest - pay much more. It’s painful to see how these small investors are fleeced every day. It’s also painful to see how those with very little money get zero attention.

Why should investors pay too much for too little, especially those who don’t have a lot to invest?

That’s why we created SquirrelSave. We can now help anyone anywhere invest without the need for investment knowledge or high fees. And they can invest or withdraw anytime.

Paying too much in Singapore?

In the Singapore unit trust industry, be careful not to pay too much for too little! Unit trusts fees in Singapore are higher than the global average.

According to the Morningstar’s Global Investor Experience (GIE) Report covering 26 markets across North America, Europe, Asia and Africa published on 18 Sep 2019, Singapore a less investor-friendly market in terms of fees and expenses than other parts of the world. In the report, Singapore was graded “below average” – for the second year running because unit trust investors in Singapore pay higher fees than in other markets. Even Thailand, China and India are ranked higher than Singapore!

What Smart Investors should look for…

Risk-Adjusted Returns

As you should know, higher potential returns require taking higher risks. What they don’t tell you is that higher risks – also mean higher potential losses! Hence, a smart investor will look at the risks taken in order to generate the actual returns. This means you should look at paying for risk-adjusted returns. What is the investment return per unit of risk taken?

At SquirrelSave, we use artificial intelligence (AI) to manage risks first. Humans cannot manage risks – which require massive data calculations all done in real-time – to make sense of the situation. Unlike humans, SquirrelSave does not sleep and aims for good risk-adjusted returns 24/7.

Next, SquirrelSave manages the portfolio to be in line with your chosen risk-reward profile. Humans cannot do this in great numbers – and tend to serve those with lots of money while avoiding small investors. Unlike humans, SquirrelSave is fully AI and can serve anyone for as little as $1!

Pay for Performance

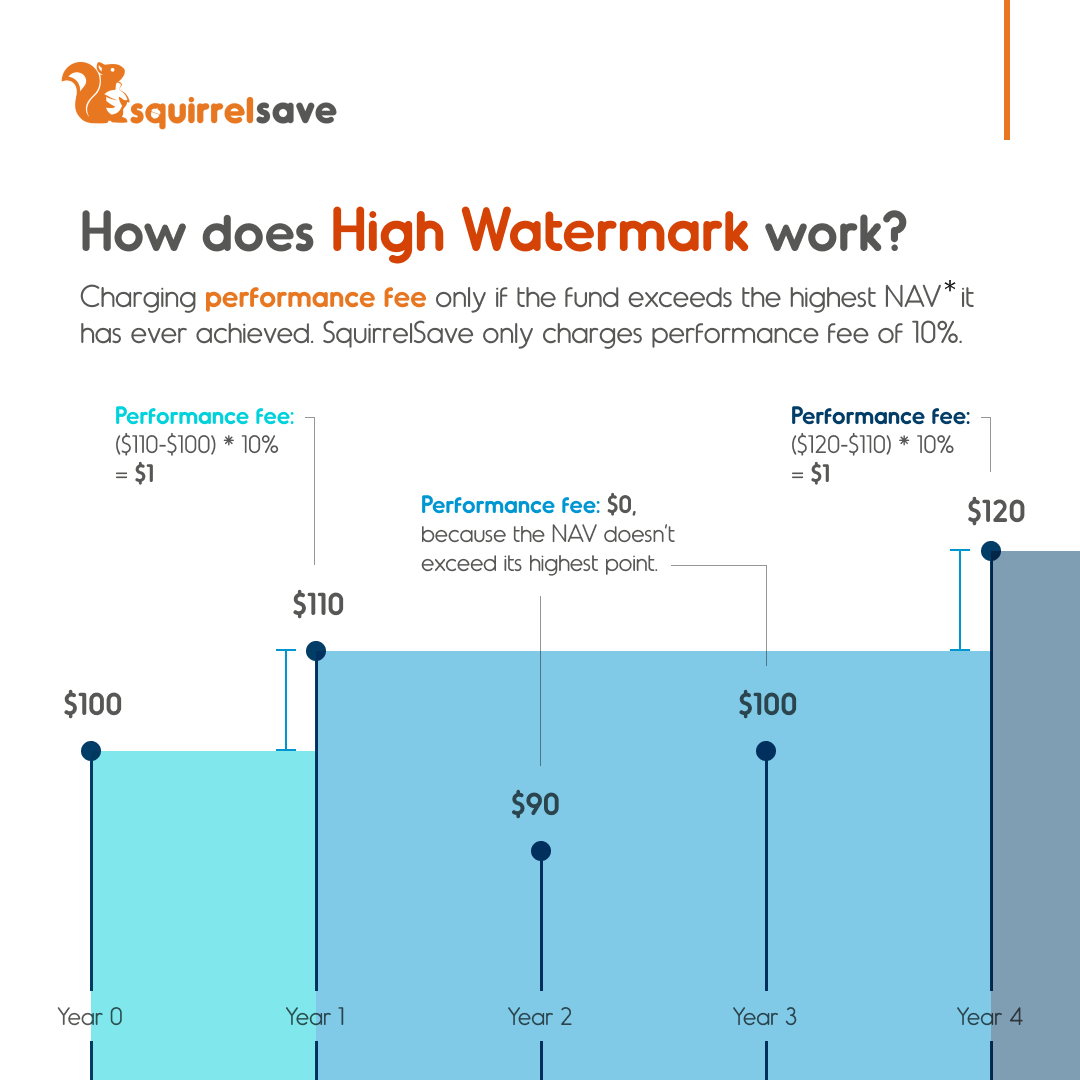

A Performance Fee structure is aligned with your interest. It is paid out of actual returns achieved, and not from the base capital. A high watermark will make it fair that the investor only pays for actual positive returns over the investment period.

A human investment manager rewarded by performance fees may take excessive risks because of greed. However, SquirrelSave portfolios are managed by machine learning AI. Machines don’t have that human greed and will remain consistently objective.

Unit trust investors should consider SquirrelSave

Unit trusts in Singapore continue to grow. According to the MAS Asset Management Industry Survey 2018, the retail unit trust industry had SGD 100 billion in assets! That’s a lot of high fees that investors are paying!

At SquirrelSave, you get a personal investment that is fully AI-driven and forward-looking. Start with any amount. Top-up or withdraw anytime. Enjoy a flat and low annual management fee. Pay only for actual investment performance based on a high watermark.

*NAV based on underlying USD value.

For example, you start a US100 SquirrelSave portfolio - and at the end of the year, the US100 grows 10% to US110, SquirrelSave will earn a Performance Fee of US1 (calculated as 10% of US10).

Let’s say in Year 2, the portfolio does poorly and drops from US110 to US90. SquirrelSave earns zero Performance Fee.

Then say, in Year 3, the SquirrelSave portfolio rises from US90 to US100. SquirrelSave does not earn a Performance Fee.

Why? Well, the last time SquirrelSave earned a Performance Fee was when the portfolio was worth US110. With a high watermark, it means that SquirrelSave can only earn a Performance Fee again – when the SquirrelSave portfolio crosses the US110 high watermark.

Exchange-Traded Funds (ETFs) are good alternatives to unit trusts

At SquirrelSave, we invest in Exchange-Traded Funds (ETFs) which offer lower expense ratios, better transparency and good diversification.

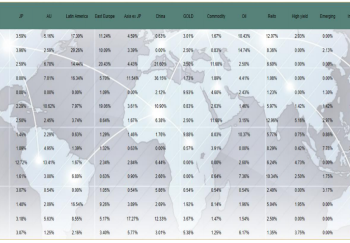

ETFs are still a relatively small proportion of the global total fund assets. But ETFs are growing very fast – mostly in the Western Hemisphere1.

In Asia and Singapore, ETFs are hardly talked about by mainstream retail financial institutions – perhaps because of vested interests to charge higher unit trust fees. You should know better.

Conclusion

Unit trusts are like dinosaurs waiting to be replaced with ETFs. Yet ETFs are slow to take off in Asia – mainly because of vested interests in selling high fee earning products. This cannot be good for investors, especially small investors.

It’s time for investors to experience low-cost ETFs in SquirrelSave’s global portfolios which are designed in real-time for each investor – whether for US1 or US1 million.

Without human greed, our AI-driven SquirrelSave’s Performance Fee structure is aligned with investors.

Welcome to the World of Smart Investing!

[1] According to the Investment Company Institute, global ETF assets stood at US$4.7 trillion at end-2018 and is forecast by BMO Global Asset Management to double in assets to $10 trillion within the next five years. Yet, global ETFs amount to just over 10% of the total fund assets worldwide. In the USA, ETF assets stood at $3.8 trillion at end-March 2019, about one-fifth of the mutual funds' $19.3 trillion in assets.

More Articles more

The Good Old Days,

and The Fantastic Days

Ahead...

May 7, 2019 | Victor Lye, CFA CFP®

Many years ago, when I was a

stockbroker, I researched companies

listed on various stock exchanges.

Based on my research, ...

Read more

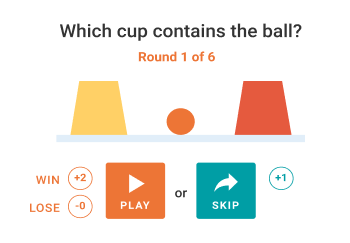

Serious Gaming

in Improving Risk

Profiling Analytics

Team SquirrelSave

SquirrelSave breaks new ground with

gamification of risk profiling to restore

some order to the muddied world of

personal investing.

Read more

SquirrelSave’s Factor

Analytics Machine

Learning Engine

Team SquirrelSave

Factor Modelling is a financial model

that employs single or multiple factors

in its calculations to explain market

phenomena and/or equilibrium...

Read more