Market Update – 1 Sep 2020

Sep 1, 2020

Our Investment Approach

At SquirrelSave, we advocate a globally diversified approach to investing with a time horizon of at least one year. SquirrelSave advocates first - to manage risks - before chasing returns.

This core belief needs repeating as recent sizzling stock market moves have understandably led to investors focusing on returns rather than risks.

Covid Investment Experience

How human sentiment changes in a short 4 months from the early Feb/Mar 2020 Covid market crash. This again reinforces the reason why I set up SquirrelSave. It is another investment experience (and now, datapoint) for SquirrelSave’s investment philosophy.

People now look at the few stocks that moved the most and ask why they did not buy it in the first place. Or why diversified investment portfolio returns are not as high as these stocks! That’s like comparing betting on the winning horses – after you know the winners. But you know, that’s quite understandable. This behaviour has been repeated many times. No, not in this recent Covid market situation – but over the decades since impressionable memories of the stock market boom and busts from the Great Depression!

Stop Betting, Start Investing

To be realistic, I expect this behaviour to persist. Hence, it is quite normal for seasoned investors to have trading portfolios (betting). However, as a seasoned investor myself, I now advocate that wise investors should allocate part (if not a substantial portion) of their investible assets into a globally diversified portfolio.

Frankly, setting up a global, let alone a diversified, portfolio is not easy. Surely, it is easier to track and talk about 10 stocks (horses) than to track all the horses running in horse races – all over the world as the earth spins 24 hours – and then to select a combination of horse bets where the probability of winning (and losing) suits your personal risk (betting) appetite!

Leverage the Power of AI

Well, until data became cheaply and widely available in real-time, with the computing power and connectivity bandwidth to allow AI techniques to do the horse work!

I would say this was not possible for the average person to access at low cost before 2015. Until recently, quantitative methods were used by highbrow, high-net-worth-client-focused investment firms (or hedge funds). Yet their investment philosophy was a black box (trade secret), mostly “alpha” targeting above market high returns (and therefore, high losses too).

It’s not difficult to search the internet for independent, academic studies of such “active” managers (horse betters) to see that most do not consistently perform well.

So, is it more skill or luck? This is another debatable topic which I will leave aside. Let’s just say that humanly speaking, it’s going to be hard to concede the need for humans to market their services (and skills) with another human.

Global State of Play

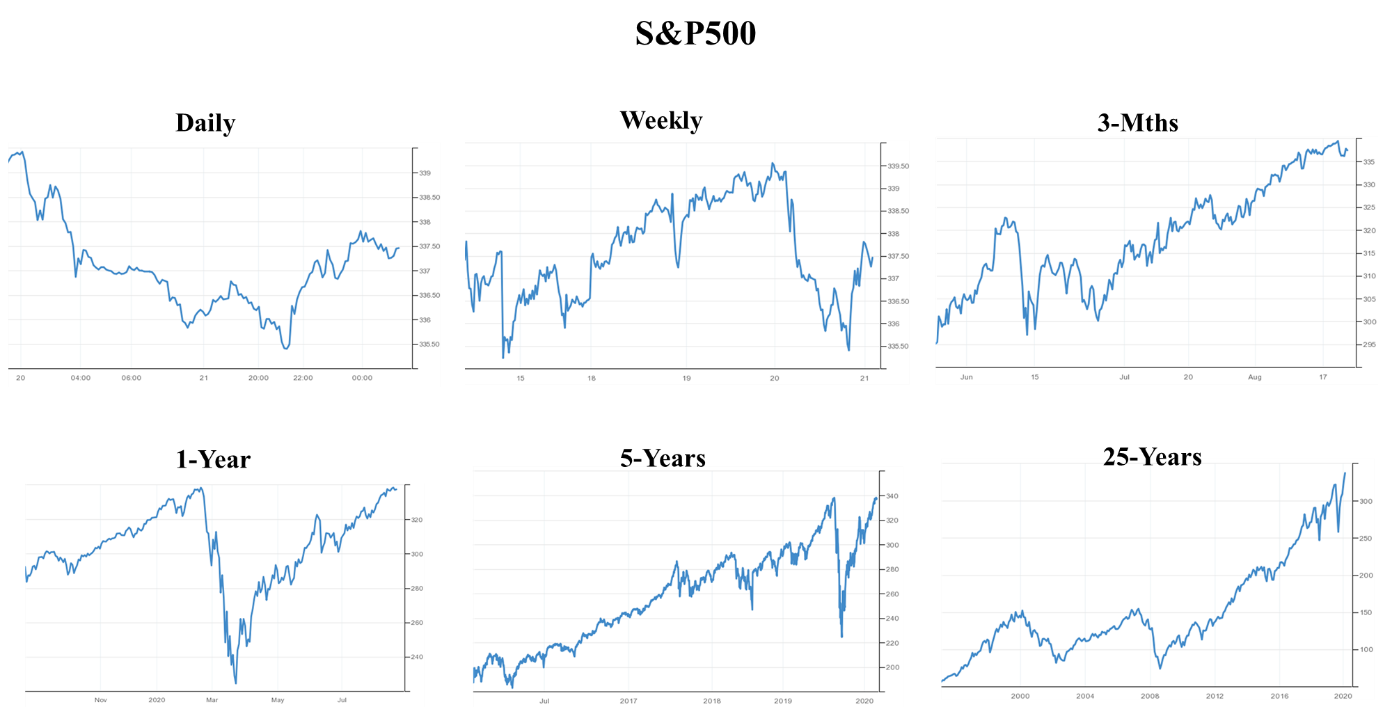

Let’s take a look at markets. In my blogs, I refer frequently to the S&P500 as a flagship market in global investing - unlike the Nasdaq Composite which is tech and healthcare heavy.

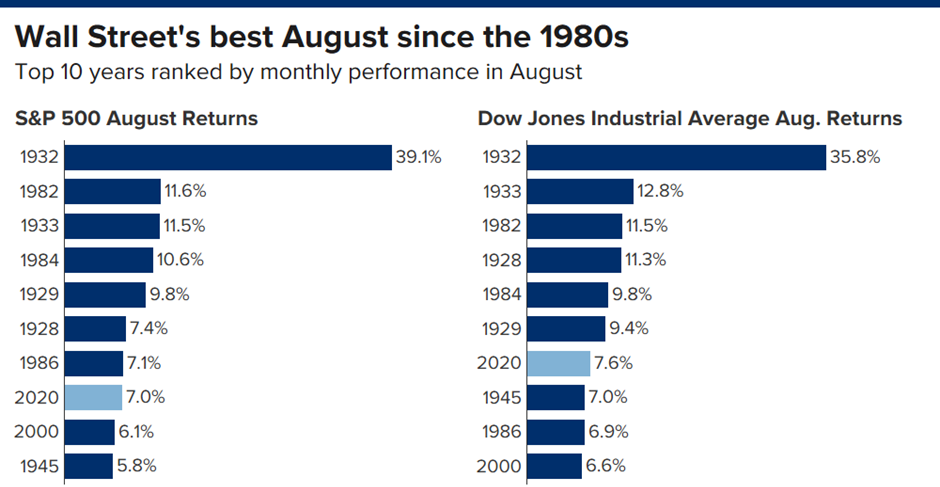

August 2020 has seen a blistering recovery for the Dow Jones Industrial Average (DJIA) and S&P500. While the DJIA remains around 4% below its pre-Covid high, the S&P500 has finally broken through and setting new record highs.

In this heady market, investors once again, as proven by history, seem to have quickly forgotten the Covid scares of early 2020. Optimism about Covid vaccines, continued monetary easing, and to some extent, retail investor forays – contributed to the market gains, driven mainly by tech companies stimulated by the Tesla and Apple stock splits.

Slowly Recovering…

The global economy is slowing recovering from the Covid downturn, fuelled by massive fiscal and monetary stimulus. But we expect the recovery to be in starts and stops if repeat Covid infection waves occur.

- China’s Caixin/Markit Manufacturing Purchasing Managers’ Index(PMI) expanded the fastest in a decade – indicating rebounding demand as new export orders rose for the first time in 2020.

- In Japan and South Korea, factory output contracted the least in 6 months, and appears to be turning around the corner.

- In other parts of Asia, recovery remains patchy as governments try to eke out bilateral essential travel and reciprocal Covid border arrangements.

- Even as the S&P 500 saw its biggest August gain since 1984 and is now setting new record highs, over half of the constituent companies included in the index are still below their previous highs.

- The Nov 2020 USA presidential campaign is picking up and may affect market volatility ahead.

Time smooths out volatility

I had shared how my SquirrelSave portfolio performed (and how our AI system worked) through the Covid crash.

At our last update mid-August 2020, I was happy with my SquirrelSave portfolio. One thing to point out is that I first funded the portfolio (Very Aggressive risk rating) in June 2019. So it had the benefit of driving through the ups and downs of the global market terrain for 14 months.

Ride the inevitable investment volatility with time. This is something that investors must try to understand. As you can see in Table 1, the S&P500 seems more volatile without a clear trend in the shorter tenures. But the 25-year chart shows a clear trend.

In investing, it is futile to time the market. You are relying on short term noise and trading signals, and there is an even chance you will get it wrong. Know what we do not know, it is better to start investing when you have enough spare cash and are clear about the risks you are willing and able to take.

At SquirrelSave, you can start with any amount. So there is no longer any excuse. Play our SquirrelSave Risk ProfilerTM to assess your own risk-reward behaviour and let our SquirrelSave system generate a globally diversified portfolio for you in seconds.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Anyone Can Enjoy Smart Investing – Starting From One Dollar

Team SquirrelSave

A one dollar global portfolio? Yes! SquirrelSave is designed to help anyone invest with low cost, using the power of AI and global diversification.

Read more

Time to Take Stock of Investing (no pun intended)

Team SquirrelSave

Since our launch, we had a decent ride managing market risks using our machine learning AI engine. The Covid crash showed that our system is crash-proof.

Read more

Glad that SquirrelSave is Navigating Smartly Amidst this Crisis

Team SquirrelSave

Two weeks since I wrote about SquirrelSave’s bold allocation to Gold in my portfolio (and yours too, if you are a SquirrelSave client), Gold continues to rise.

Read more