SquirrelSave AI seems to know something’s happening

Feb 12, 2022

Increased Allocation to Gold & Nasdaq in recent AI-driven rebalancing

The Jan 2022 market correction resulted in the SquirrelSave AI algorithms rebalancing the various reference portfolios.

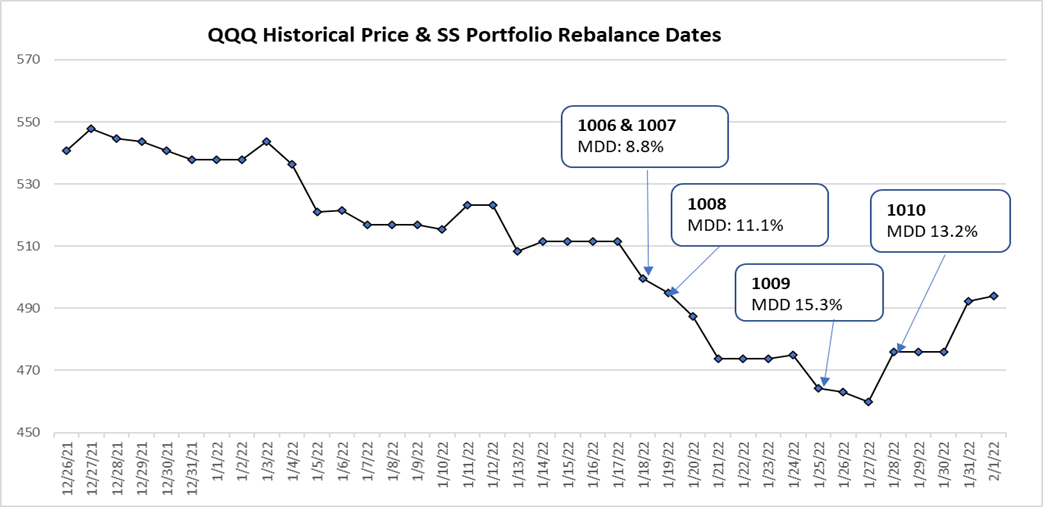

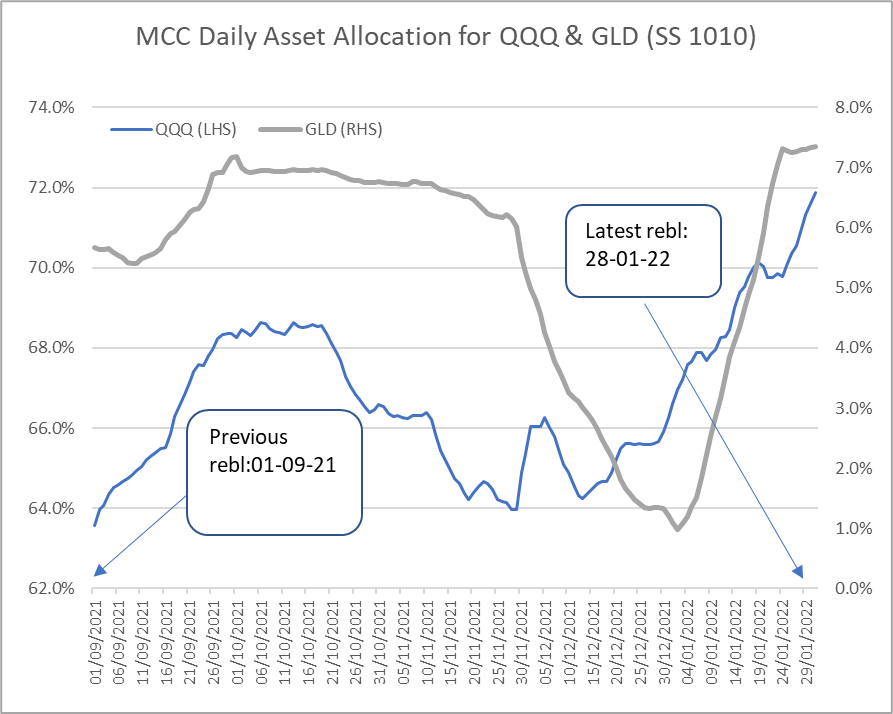

In reviewing our SquirrelSave AI algorithms, we noticed a very interesting development. In particular, SquirrelSave’s allocation to GLD (SPDR Gold Shares ETF) and QQQ (which tracks the Nasdaq 100 Index) has increased. The chart below shows rebalancing dates triggered by SquirrelSave’s algorithms for SquirrelSave Reference Portfolios (numbered 1006 to 1010).

Source: SquirrelSave

Notes: Portfolio numbers 1006 to 1010 represent risk-labelled reference SquirrelSave (SS) portfolios of Conservative, Balanced, Growth, Aggressive & Very Aggressive. “MDD” refers to the max drawdowns.

The last time we noted SquirrelSave allocating a high weight to Gold was in Nov 2019 when we first launched the algorithms. At that time, it was puzzling and exhaustive rounds of review were done to rule out human or data error.

It became clearer by Feb 2020 when market volatility increased significantly because of the rapid Covid-19 spread and impact on economic activity globally. As it turned out, the larger than expected Gold holdings helped SquirrelSave’s reference portfolios weather the Covid-19 market crash in Feb 2020 until markets generally recovered in April 2020.

What is SquirrelSave telling us via its significant allocation to Gold this time?

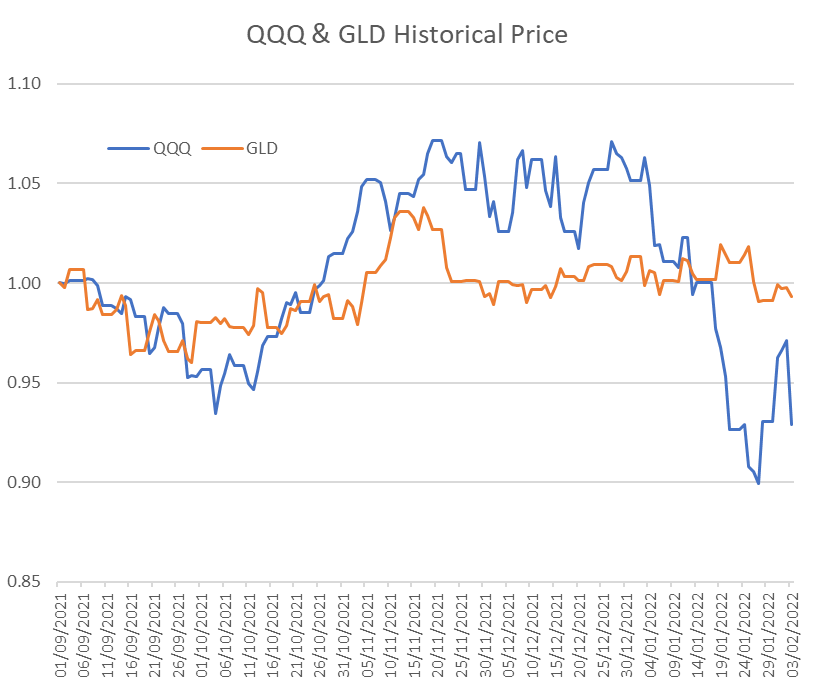

Our quantitative investment team believes that based on the analysis of QQQ & GLD prices and the SquirrelSave portfolio rebalancing dates, the reference portfolios are expected to outperform when the market recovers.

A closer look at the latest Gold price movement suggests a possible breakout.

We will watch this closely as we manage the downside risks of our SquirrelSave portfolios during this current period of heightened volatility.

Regards,

SquirrelSave AI Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

SquirrelSave ONE Dollar Reference Portfolios

Team SquirrelSave

As SquirrelSave offers global portfolios from as low as ONE Dollar, we showcase the ONE Dollar portfolios below.

Read more

SquirrelSave Reference Portfolios riding out short term volatility

Team SquirrelSave

Volatile start to 2022 for both equity and bond markets

Read more

5 Investing Insights & Strategies From Chinese New Year Games

Team SquirrelSave

Gambling is a huge part of the Chinese New Year festivities. Pick up some investment knowledge while enjoying these popular CNY games!

Read more