How Covid-19

Affects Investment Strategy

January 30, 2020

The Year of the Rat has rocked the world with Chinese New Year “GONG XI FA CAI” greetings and worry about the Covid-19 outbreak. Should we panic or carry on as we do just like the seasonal flu we live with every year?

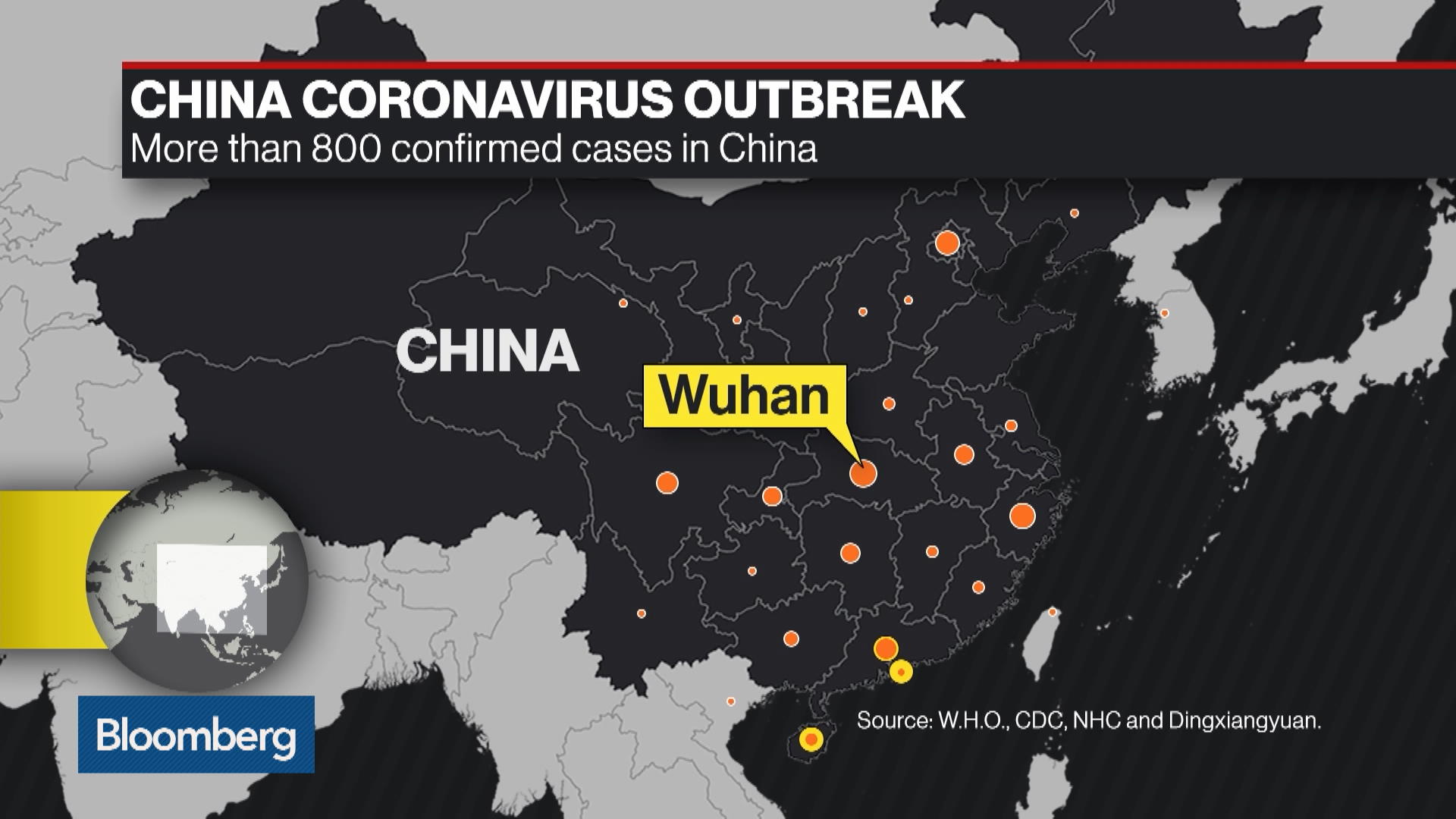

By end-Jan, China officially reported over 8,000 confirmed cases and over 180 deaths. The lockdown of Wuhan and other parts of China combined with travel restrictions are unprecedented. So far, there appears to be some containment with several countries reporting confirmed cases, but in smaller numbers. Many countries are advising against travel to China.

The rapid spread of the Covid-19 from the epicenter in Wuhan city to every region in China shows it is highly contagious. It also reflects the mass travel patterns during the annual Spring Festival. As with any flu outbreak, there will likely be an acceleration in the number of infections before it peaks and slows down. In the meantime, stay away from high-risk areas, practice good personal hygiene and use common sense. Wearing a mask is not sufficient nor adequate. Nonetheless, sick people should wear a mask to reduce the risk of infecting others. But what about our investments?

Sector Impact

The obvious beneficiaries will be sectors such as Pharmacy, Medical Equipment and Medical Supplies such as masks, medicine and detection reagents. What do people do when indoors or quarantined? Online gaming, home entertainment and e-commerce will be in demand. However, many industries will suffer badly. Transportation, hospitality and travel will see revenues plummet. Energy prices may fall with reduced demand. With China in lockdown, South East Asia will feel the pain. In 2019 data, South East Asia was the most popular destination for Chinese tourists. There will be multiplier effects across domestic industries that support the travel and tourism sectors in each Southeast Asian country.

Asset Allocation

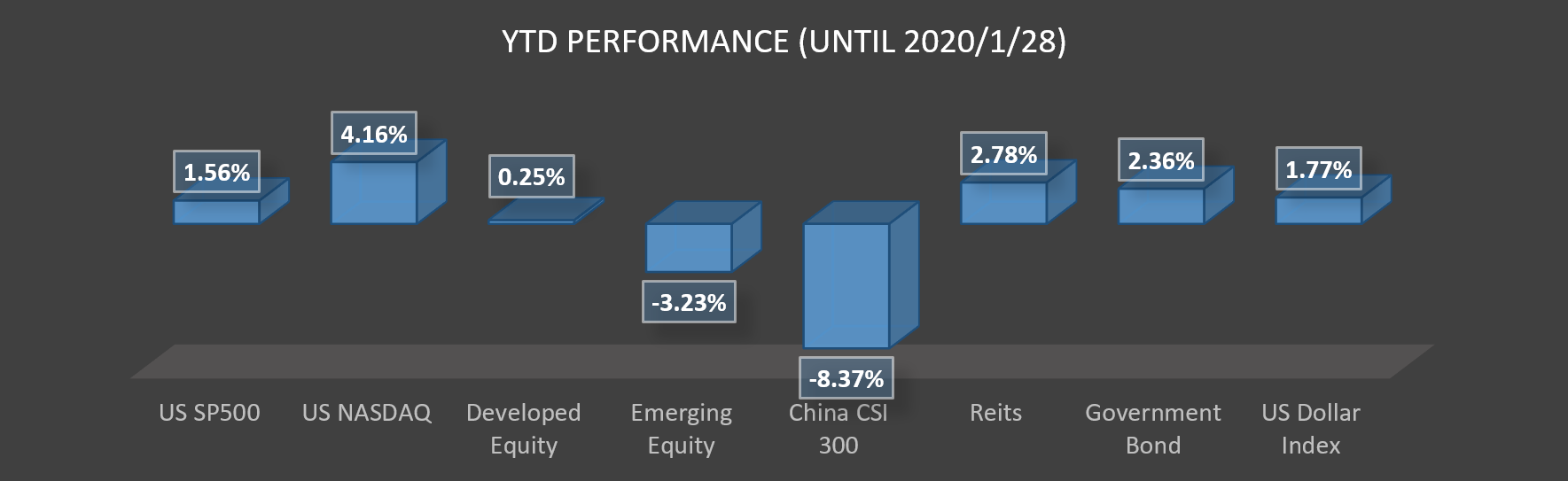

The Covid-19 may hog the headlines, but the US-China Trade War is still a major dampener. While the US-China Phase 1 trade deal is a welcome relief for China, we also note that China cannot weaken the Yuan indefinitely. Hence, SquirrelSave portfolio reduced exposure to China in late Dec 2019 – even as the Covid-19 situation gained attention. SquirrelSave has shifted towards the US and developed markets focused on yield generating investments such as REITs and Bonds – while watching the USD-SGD FX movements. Cash level is healthy to protect recent gains.

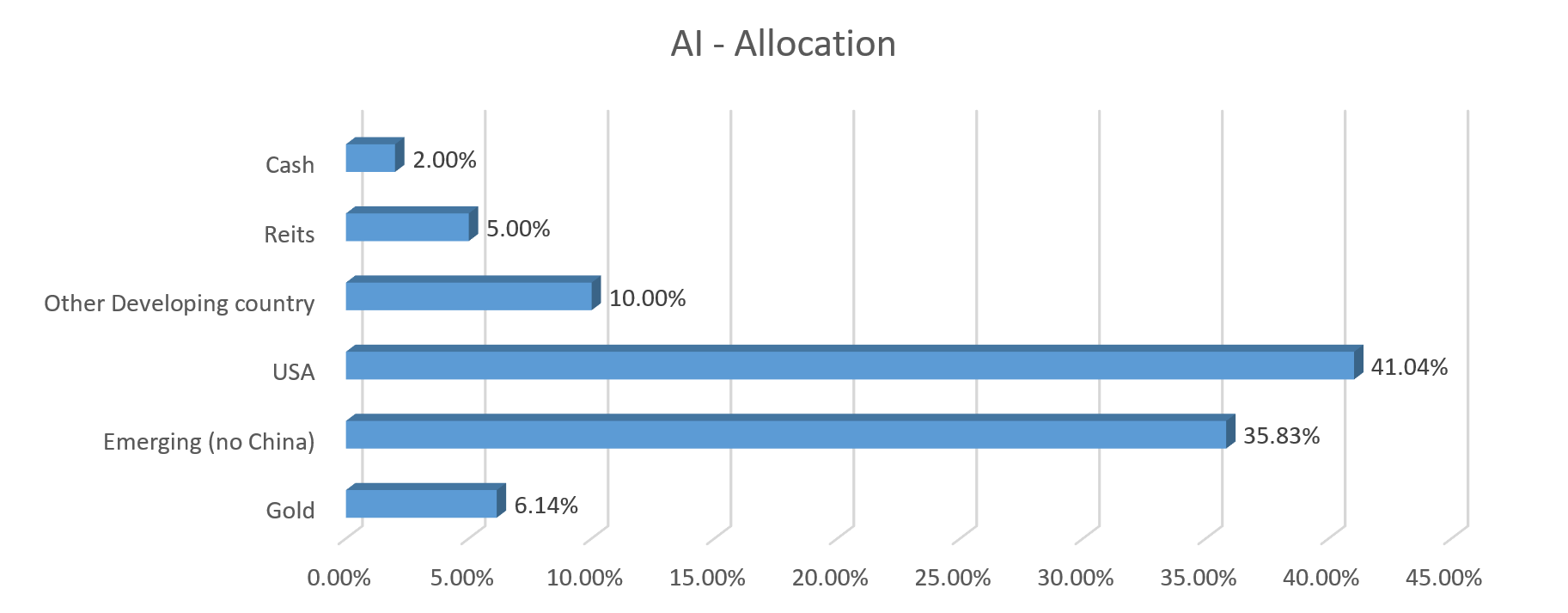

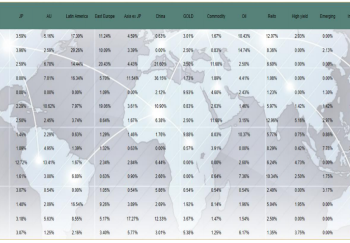

The Covid-19 outbreak cannot overshadow data analytics. The US Non-Farm Payroll dropped to 145K from 256K over the previous month, suggesting the Fed may keep easing monetary policy. We think China will have to stimulate growth – even more so with the impact of the Covid-19 outbreak. Hence, our SquirrelSave AI Classification model is predicting a Bull market scenario – for which we show the risk-return optimized allocation weights for the Aggressive risk profile.

At SquirrelSave, our algorithms have been trained with 15 years of data and tested with 3 years of validation through real-time market experience. Even with sudden market impact events such as the Covid-19 outbreak, SquirrelSave continues to look forward with no human bias and knee-jerk reactions – based on data and time horizon relevant to your risk-reward profile.

Stay calm and practice good hygiene, even with your SquirrelSave investments!

More Articles more

Serious Gaming

in Improving Risk

Profiling Analytics

Team SquirrelSave

SquirrelSave breaks new ground with

gamification of risk profiling to restore

some order to the muddied world of

personal investing.

Read more

SquirrelSave’s Factor

Analytics Machine

Learning Engine

Team SquirrelSave

Factor Modelling is a financial model

that employs single or multiple factors

in its calculations to explain market

phenomena and/or equilibrium...

Read more

Stop Paying for Bad Performance

Team SquirrelSave

In the investment world, those who

have more money pay the lowest

fees. Those who have less money to

invest - pay much more. It’s painful to

see how these small investors are...

Read more