SQUIRRELSAVE INVESTMENT OUTLOOK 2022

Dec 21, 2021

Covid-19 saw dramatic expansionary fiscal and monetary policies across the world in 2020 and 2021.

2022 will see a transition toward a more normal situation if new Covid-19 variants are not worse than what we already know.

SquirrelSave sees the global economy growing 3% to 4% in 2022. This may be revised down if the latest Omicron Covid-19 variant renders vaccines ineffective or overloads national health systems.

SquirrelSave highlights 3 main factors that will affect investment markets.

- US Federal Reserve Taper

- Global Supply Chain Bottlenecks

- China’s Economic Performance

1. US Federal Reserve Taper

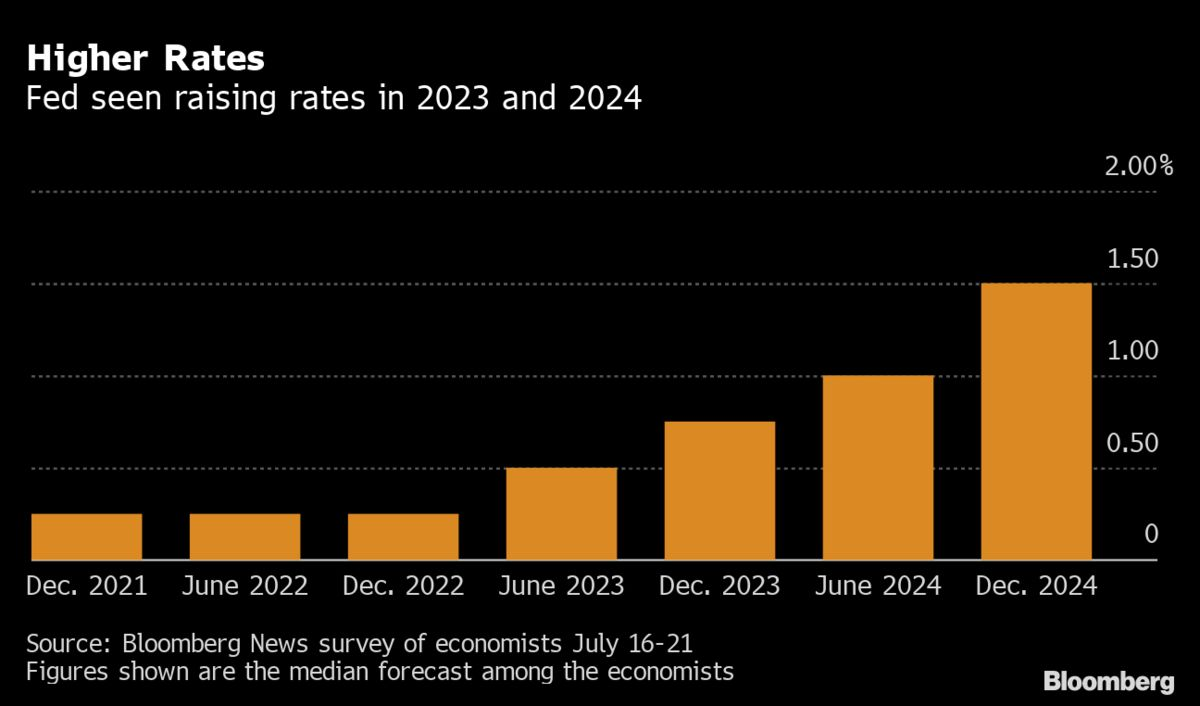

The Federal Reserve announced in Nov 2021 that it will begin unwinding (often referred to as “tapering”) its $120 billion monthly bond and mortgage security purchases.

In the aftermath of the 2008 Global Financial Crisis and the early months of the Covid-19 pandemic in 2020, the Fed committed to buying long-duration bonds and mortgage securities to keep borrowing costs low and to stimulate the economy. This led to higher asset prices reflected in the buoyant stock market.

As we enter 2022, the big question is whether the Fed taper will push interest rates higher and dampen the stock market.

It is likely that the Fed will taper slowly while giving adequate signals to the market so that volatility will be less severe. Another consideration that the rise in interest rates will be well absorbed is the fact that ‘risk-free’ debt such as German 10-year bond yields are near zero, at 0.07%. Likewise French, Irish, Dutch, and Swiss yields are hovering at near zero. There is an estimated USD 10 trillion in negative-yielding global debt, meaning investors need to pay to own those bonds. Therefore, long-duration U.S. Treasuries look attractive to global investors, and continued demand can temper the rise in interest rate yields.

2. Global Supply Chain Bottlenecks

Concerns over whether the current inflation pressures are transitory or here to stay depend on the global supply crunch.

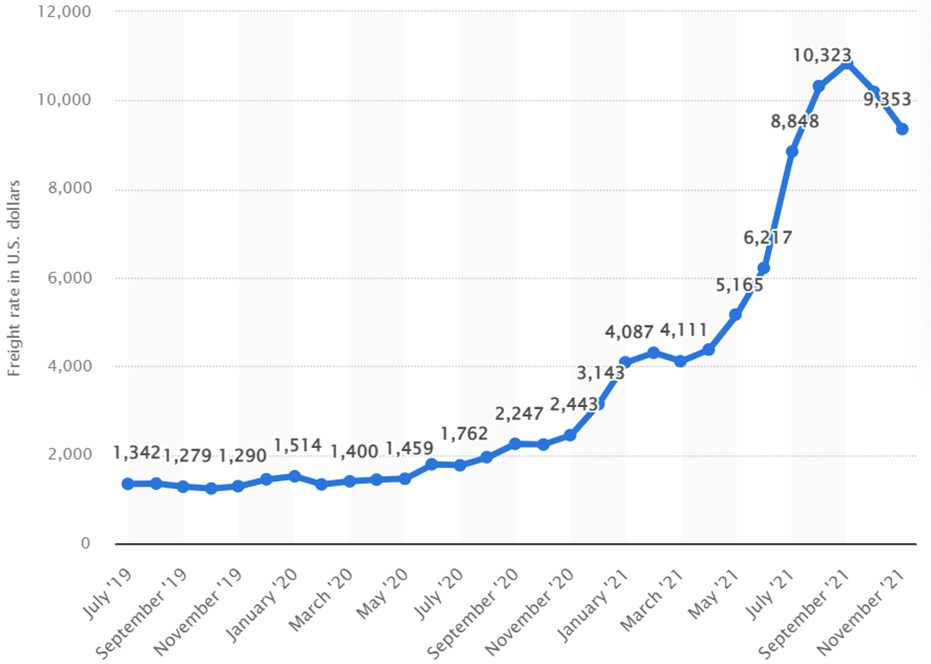

Rising raw material and energy costs, chip shortages, crowded ports and delayed deliveries are manifesting at the retail consumer level. Ocean freight rates are at near-record levels and there is a shortage of long-haul truck drivers.

As companies, investors and policymakers fret over port logjams, freight costs and chip shortages, some indicators are starting to signal that global supply chain stress may be on the wane.

- Freight rates are coming off their highs in Oct 2021.

- Supply chain bottlenecks may clear by 1Q2022 as seasonal demand drops sharply and inventories are rebuilt.

- Chip shortages may ease in early 2022.

- China’s economic slowdown and property market slump may see commodity prices easing.

3. China’s Economic Performance

China accounts for a fifth of the global economy but 30% of global growth. China’s economy is expected to grow 5.3 percent in 2022 amid headwinds from a property downturn, weakening exports and strict zero COVID-19 targets. These issues may well affect consumption and global growth will be dampened.

China Economic Growth Slowing Down

Source: Statistica

If China’s property defaults are not well managed, there is the risk of a hard landing for the property sector. It may lead to a domino effect as failed land auctions in big cities cause falling property prices in smaller cities.

China’s tightening on tech regulation in 2021, and China’s move to wean property developers away from rampant borrowing, will translate into potential loan losses for banks and pain in credit markets. For example, property behemoth China Evergrande has become China’s largest default.

Outlook 2022

Inflation or Stagflation?

Late 2021 has seen energy supply bottlenecks. Commodity prices, and in particular, coal have pushed production costs up. As global demand recovers from Covid-19, expect inflation to rise.

Expect this to be short-term as supply catches up. There is excess capacity due to Covid restrictions.

As more countries embrace climate change policies, expect energy costs to rise with compliance costs.

Notwithstanding, we are entering an inflation upturn given the mild price behaviour and low to negative real interest rates of last 10 to 15 years.

Need to watch if growth trails off as inflation rises. Stagflation will raise risks for governments that have accumulated unprecedented Covid-era debts.

US Economy will slow down in 2022

Expect the US economy to slow down after a strong recovery in 2021. Remember that 70% of the US economy is consumption driven. Will have to watch if consumption can return to pre-Covid levels.

Europe will slow down in 2022

Europe’s economy continues to struggle as post-Covid momentum is fading.

China is the swing factor in 2022

Like the US and Europe, China will slow down in 2022. Although China’s economic size is 20% of the global economy, China drives more than 30% of global growth. Hence, China’s growth momentum will likely decide the global outlook in 2022.

Asset Allocation

Covid economic pump priming has resulted in negative real interest rates. This has caused asset inflation. Hence, current asset valuations appear out of sync with the business cycle.

Key asset allocation adjustments will depend on how returns behave across the various asset classes, and especially for US equities.

SquirrelSave AI will continue to keep an eye on downside risks.

Negative real interest rates are likely to stay, even though we expect real rates to become less negative over the next 5 years.

With high global debt worsened by Covid-era government spending, returns are hard to find in quality debt. Hence, bond market action is likely in the riskier segments, such as high yield credit and emerging market debt.

Equities will likely remain overweight for the next five years.

The Rise of Digital Assets

Many countries have clamped down on crypto businesses, and China has even outlawed digital assets. In contrast, Singapore is well positioned for the next decade as global macroeconomics and accelerating post-Covid digitalisation shape the future “tokenized economy”.

As a global financial centre, Singapore will be a key player for cryptocurrency-related businesses. SquirrelSave AI intends to harness this game changer in financial services.

The Monetary Authority of Singapore (MAS) promulgated the Payment Services Act (PSA) to regulate exchanges and other cryptocurrency businesses from January 2020. Over 400 firms will operate under the PSA.

Singapore is likely to speed ahead in digital assets as an asset class in wealth management. Dubai, Malta and Switzerland, are also welcoming crypto developments.

SquirrelSave is already in this space having launched its first digital assets fund for Accredited Investors in Sep 2021.

SquirrelSave sees digital assets growing as an asset management business and as an asset class.

Digital assets will be key as crypto adoption goes mainstream and its technology powers more disruptive use cases, including DeFi apps and the Metaverse revolution.

What’s clear is that investing is going digital and borderless. That's what SquirrelSave is about. Join our world of Smart Investing for Anyone, Anywhere, Anytime!

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

7 Ways SquirrelSave AI is Revolutionising Investing

Team SquirrelSave

Frequently dubbed one of the "next big things in tech", Artificial Intelligence (AI) applications have significantly evolved. From search engines to money management, AI brings unique solutions and possibilities to the table with its ability to harness vast amounts of data and make inferences about new data – beyond human capabilities.

Read more

SquirrelSave Reference Portfolios Doing Well Despite Headwinds

Delivered +15% to +25% Returns YTD end-Nov 2021

Team SquirrelSave

November saw US equity markets setting new record highs but fell abruptly at month-end due to fears over the emerging Omicron Covid-19 variant, stubbornly high inflation due to global supply constraints and worries about the Federal Reserve’s next steps.

Read more

SquirrelSave ONE Dollar Reference Portfolios

+14% & +19 during Jan-Nov 2021

+21% & +33% in 18 months since May 2020

Team SquirrelSave

We track two actual ONE Dollar SquirrelSave portfolios which started in May 2020.

Read more